What Is an Indexed Annuity?

An indexed annuity, commonly referred to as a ratchet annuity, is a financial contract issued by an insurance company to an individual looking to save for retirement.

In exchange for an upfront payment, the insurer provides the individual, or annuitant, the opportunity to grow his money based on the performance of a stated index, such as the Russell 3000. The insurer also provides downside protection, guaranteeing a minimum rate of return, which will never be less than zero.

Generally, an indexed annuity consists of two phases:

- An accumulation period where the insurer invests the money paid by the annuitant

- A payout period where the annuitant receives a steady stream of income from the insurer (the index component provides upside potential above a minimum guaranteed level)

Fixed index annuities are a blend of fixed and variable annuities. While the annuity offers limited market participation through the underlying index, the main feature is the floor on downside risk. Often offering bond-like returns, the fixed index annuity limits all investor losses if the tracked index goes negative over the annuity term. This can be vital for risk-averse investors or those who are approaching retirement imminently.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

Indexed Annuity Features

Beyond the basic design outlined above, indexed annuities can be structured with a variety of features. We explore the most common parts below.

Minimum Rate

A minimum rate is the guaranteed rate you’ll earn when the index performs poorly. For example, with a minimum annual rate of 1%, you can count on this return, whether the index stays flat or decreases significantly in a given year.

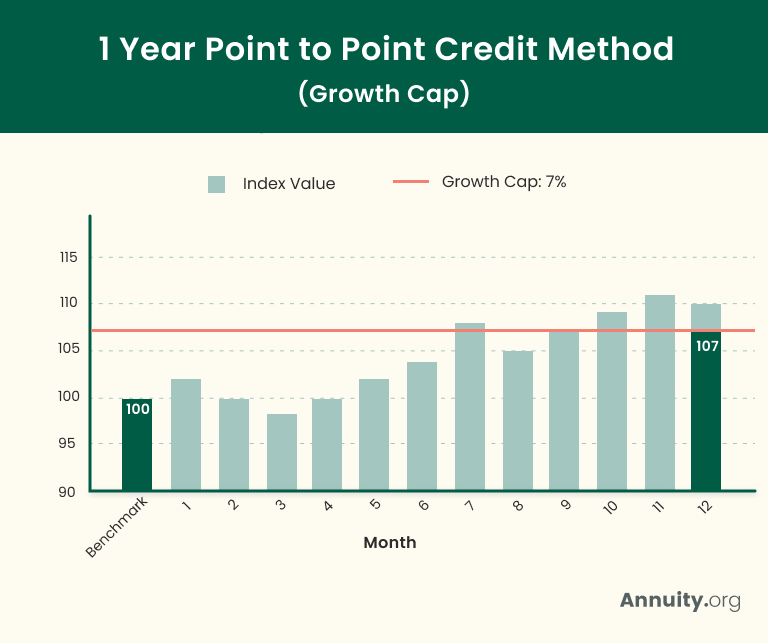

Cap Rate

A cap rate is the maximum rate of interest the annuity can earn during a measurement period. For example, an annual cap rate of 7% limits upside performance to 7% per year. If the index increases by 10%, you will only get 6% credit.

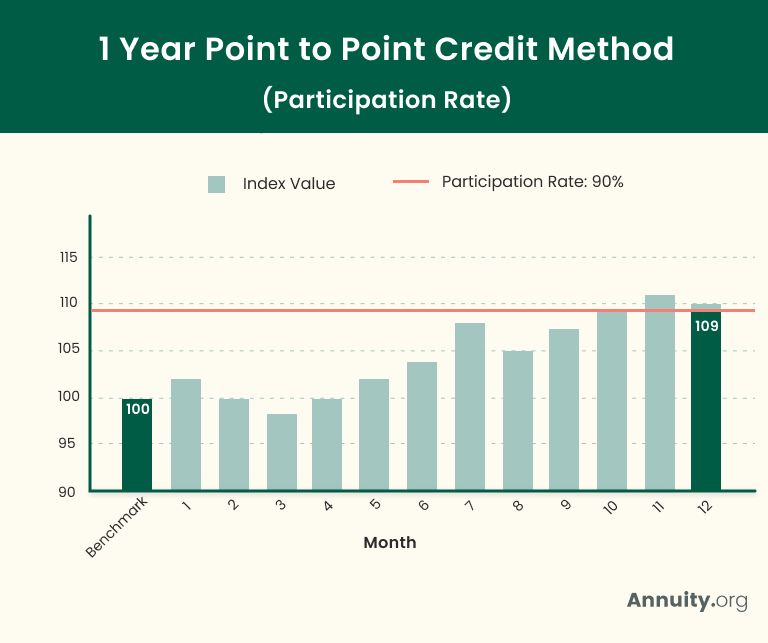

Participation Rate

A participation rate spells out the percentage of the index increase you can earn. For example, given a participation rate of 90% and a 10% increase in the index, your gain will be limited to 9% (90% × 10% = 9%).

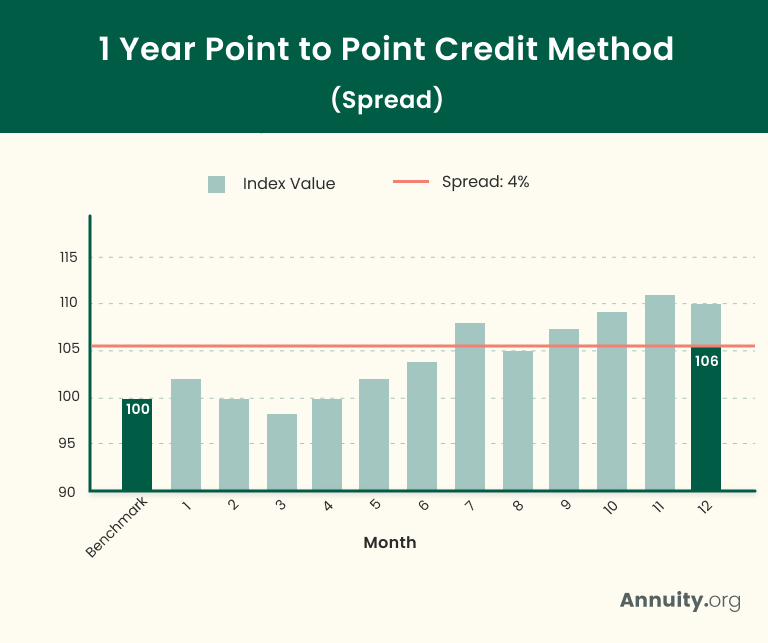

Spread Rate

A spread rate is a fixed percentage that is deducted from any increase in the index. For example, a spread of 4% will reduce your gain on a 10% increase in the index to 6% (10% – 4% = 6%). If the index increases by 3% or less, your gain will be the greater of the minimum guaranteed rate or zero.

Crediting Method

The crediting method defines how interest is calculated for a measurement period. Oftentimes, you have the ability to select a preferred crediting method.

- Annual Point-to-point

- Interest is credited based on the difference between the beginning and ending value of the index over a one-year period. Negative changes do not reduce the annuity value.

- Biennial Point-to-point

- Interest is credited based on the difference between the beginning and ending value of the index over a two-year period. Negative changes do not reduce the annuity value.

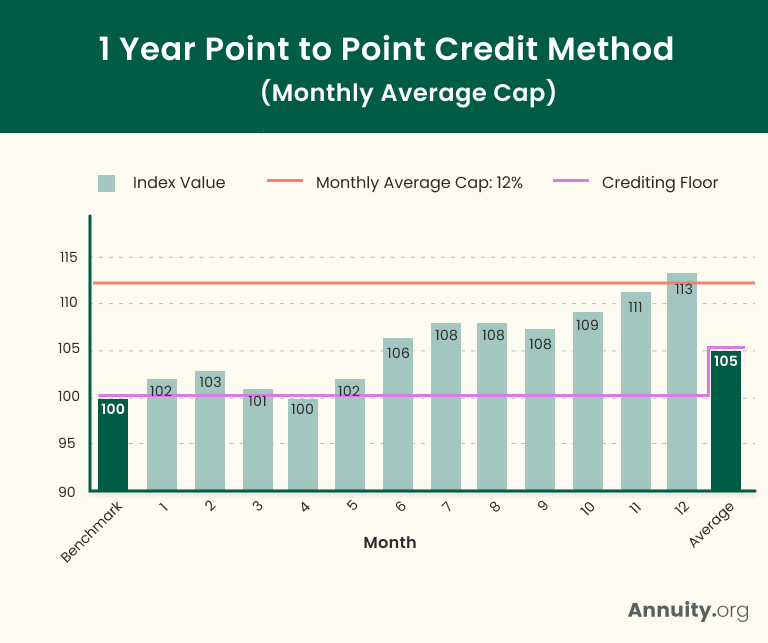

- Monthly Point-to-point Average (Annual Period)

- Interest is credited based on the average value of the index over 12 consecutive month-end periods. It works by summing the month-end values and dividing by 12. So, if the index started the year at 1,000 and the average monthly value was 1,100, the monthly point-to-point average would be 10 percent (1,100 ÷ 1,000 – 1 = .10).

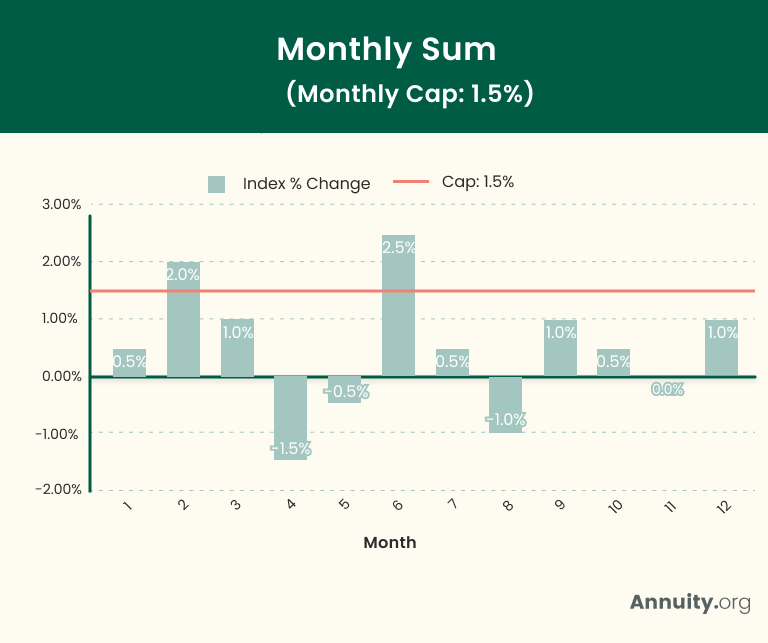

- Monthly Sum (Annual Period)

- Interest is credited based on the on the sum of the index returns for 12 consecutive months. If the total return, adjusted for any limits, is greater than the guaranteed minimum, the interest is credited to the account. If the adjusted return is less than the guarantee, the minimum rate is applied.

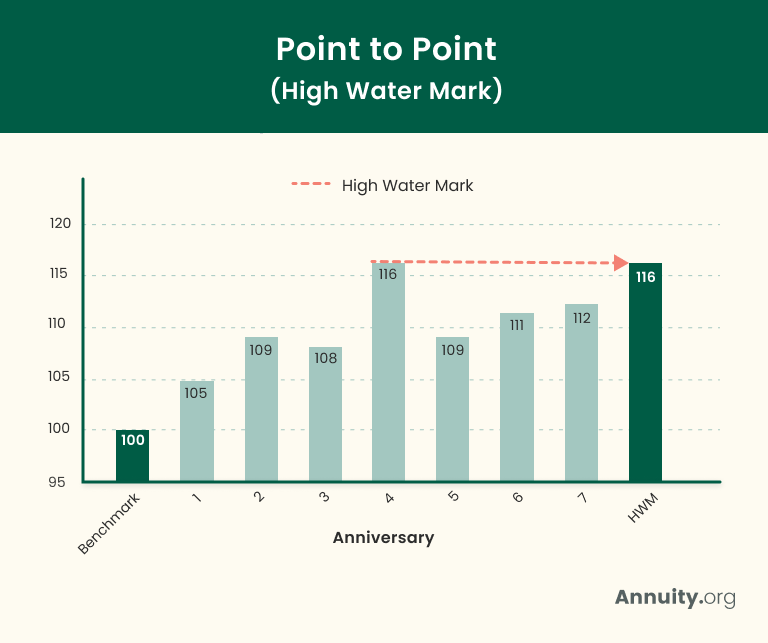

- Monthly High Water Mark (Annual Lookback Period)

- Interest is credited based on the highest month-end value reached during a 12-month measurement period versus the beginning value. For example, assume the index started the year at 1,000 and ended at 800, but its highest month-end value was 1,200. In this case, the high water mark is 1,200. So, the interest credit will be 20 percent (1,200 ÷ 1,000 = .20), subject to any limits.

Widely used methods include:

Here is an example of how a High Water Mark crediting method would impact your earnings.

The index value is tracked and recorded each year on the anniversary of the contract. At the end of the annuity guarantee period (or term) the highest anniversary value is used as the High Water Mark. The difference between the High Water Mark and the benchmark value is recorded as the growth rate applied for the annuity over this term.

Conversely, here is an example of what you would gain from a monthly sum crediting method.

| Index Growth | 0.5% | 2.0% | 1.0% | -1.5% | -0.5% | 2.5% | 0.5% | -1.0% | 1.0% | 0.5% | 0.0% | 1.0% | 6.0% |

| Credited Growth | 0.5% | 1.5% | 1.0% | -1.5% | -0.5% | 1.5% | 0.5% | -1.0% | 1.0% | 0.5% | 0.0% | 1.0% | 4.5% |

Each month’s performance is tracked and measured against a monthly performance cap. In this example, the cap is 1.5%, and any monthly performance that exceeds the cap will be limited to 1.5% as that month’s recorded performance.

After 12 months, all recorded performance metrics are added together, which gives the final growth that is applied to the annuity. In the Monthly Sum crediting method, negative performance on a monthly basis is included in the calculation, but annual performance below 0% will only yield 0% or the contractual minimum.

In the example above, the total uncapped performance of the underlying index is 6%. However, the applied performance is only 4.5% because months 2 and 6 were capped at 1.5%.

Another commonly used method is the monthly point-to-point average.

The index value is tracked and recorded each month, and at the end of 12 months, the values are averaged and measured against an annual cap.

The difference between the average value and the benchmark value is the recorded growth rate applied to the annuity. If the difference between the average and the benchmark value exceeds the annual cap, then the annual cap is recorded as the annual performance.

In this example above, the difference is 5% and is below the annual cap, so 5% is applied.

How Do the Various Indexed Annuity Structures Work?

Now that we have a basic understanding of indexed annuities and their features, let’s take a closer look at how they’re structured and how they work. The possibilities are endless, but most contracts include some combination of cap, participation and spread features, along with a range of crediting options.

Illustrations of three possible structures and their performances for 2018, 2019 and 2020 are below. For each annuity:

- The starting value is $100,000 as of January 1, 2018.

- Performance is tied to the Russell 3000; interest is credited once per year on January 1.

- The minimum annual rate is 1 percent.

The Russell 3000 monthly performance data is below.

2018 Calendar Year

| Month Ended | Beginning Value | Ending Value | % Return |

|---|---|---|---|

| 01/31/18 | 1,664.68 | 1,600.15 | -3.9% |

| 02/28/18 | 1,600.15 | 1,565.56 | -2.2% |

| 03/31/18 | 1,565.56 | 1,569.91 | 0.3% |

| 04/30/18 | 1,569.91 | 1,610.67 | 2.6% |

| 05/31/18 | 1,610.67 | 1,618.99 | 0.5% |

| 06/30/18 | 1,618.99 | 1,670.96 | 3.2% |

| 07/31/18 | 1,670.96 | 1,726.09 | 3.3% |

| 08/31/18 | 1,726.09 | 1,726.52* | 0.0% |

| 09/30/18 | 1,726.52 | 1,597.71 | -7.5% |

| 10/31/18 | 1,597.71 | 1,625.99 | 1.8% |

| 11/30/18 | 1,625.99 | 1,472.14 | -9.5% |

| 12/31/18 | 1,472.14 | 1,596.54 | 8.5% |

| SUM | -2.8% |

2019 Calendar Year

| Month Ended | Beginning Value | Ending Value | % Return |

|---|---|---|---|

| 01/31/19 | 1,596.54 | 1,649.22 | 3.3% |

| 02/28/19 | 1,649.22 | 1,660.03 | 0.7% |

| 03/31/19 | 1,660.03 | 1,734.71 | 4.5% |

| 04/30/19 | 1,734.71 | 1,619.72 | -6.6% |

| 05/31/19 | 1,619.72 | 1,730.90 | 6.9% |

| 06/30/19 | 1,730.90 | 1,754.65 | 1.4% |

| 07/31/19 | 1,754.65 | 1,715.24 | -2.2% |

| 08/31/19 | 1,715.24 | 1,742.70 | 1.6% |

| 09/30/19 | 1,742.70 | 1,778.20 | 2.0% |

| 10/31/19 | 1,778.20 | 1,842.05 | 3.6% |

| 11/30/19 | 1,842.05 | 1,892.25* | 2.7% |

| 12/31/19 | 1,892.25 | 1,888.03 | -0.2% |

| SUM | 17.5% |

2020 Calendar Year

| Month Ended | Beginning Value | Ending Value | % Return |

|---|---|---|---|

| 01/31/20 | 1,888.03 | 1,730.31 | 8.4% |

| 02/28/20 | 1,730.31 | 1,489.57 | -13.9% |

| 03/31/20 | 1,489.57 | 1,684.95 | 13.1% |

| 04/30/20 | 1,684.95 | 1,771.37 | 5.1% |

| 05/31/20 | 1,771.37 | 1,809.25 | 2.1% |

| 06/30/20 | 1,809.25 | 1,909.89 | 5.6% |

| 07/31/20 | 1,909.89 | 2,045.01 | 7.1% |

| 08/31/20 | 2,045.01 | 1,968.09 | -3.8% |

| 09/30/20 | 1,968.09 | 1,923.70 | -2.3% |

| 10/31/20 | 1,923.70 | 2,154.29 | 12.0% |

| 11/30/20 | 2,154.29 | 2,248.44* | 4.4% |

| 12/31/20 | 2,248.44 | 2,236.37 | -0.5% |

| SUM | 20.6% |

Worried About Your Retirement Savings?

Annual Point-to-point Crediting with 75% Participation Rate

Annual Credit:

GREATER OF (Ending Year Value ÷ Beginning Year Value – 1) × .75 OR 1.0%

2018:

(1,596.54 ÷ 1,664.68 – 1) × .75 = -3.1%

Since the crediting rate is negative, the minimum rate of 1.0% is earned.

2019:

(1,888.03 ÷ 1,596.54 – 1) × .75 = 13.7%

2020:

(2,236.37 ÷ 1,888.03 – 1) × .75 = 13.8%

Ending Annuity Value:

Beginning Value × (1 + 2018 Credit) × (1 + 2019 Credit) × (1 + 2020 Credit)

Ending Annuity Value:

$100,000 x 1.01 x 1.137 x 1.138 = $130,685

Monthly Sum Crediting with 100% Participation Rate and 3% Spread Rate

Annual Credit:

GREATER OF (Sum of 12 Months of Returns) × 1.0 – 3.0% OR 1.0%

2018:

-2.8% × 1.00 – 3.0% = -5.8%

Since the crediting rate is negative, the minimum rate of 1.0% is earned.

2019:

17.5% × 1.00 – 3.0% = 14.5%

2020:

20.6% × 1.00 – 3.0% = 17.6%

Ending Annuity Value:

Beginning Value × (1 + 2018 Credit) × (1 + 2019 Credit) × (1 + 2020 Credit)

Ending Annuity Value:

$100,000 x 1.01 x 1.145 x 1.176 = $135,999

Monthly High Water Mark (Annual Lookback Period) with 100% Participation and 15% Cap Rate

Annual Credit:

GREATER OF (Highest Month-end Value ÷ Beginning Year Value – 1) × 1.00 OR 1.0% OR 15.0%

2018:

(1,726.52 ÷ 1,664.68 – 1) × 1.00 = 3.7%

2019:

(1,892.25 ÷ 1,596.54 – 1) × 1.00 = 18.5%

Since the crediting rate exceeds the cap, the maximum rate of 15.0% is earned.

2020:

(2,248.44 ÷ 1,888.03 – 1) × 1.00 = 19.1%

Since the crediting rate exceeds the cap, the maximum rate of 15.0% is earned.

Ending Annuity Value:

Beginning Value × (1 + 2018 Credit) × (1 + 2019 Credit) × (1 + 2020 Credit)

Ending Annuity Value:

$100,000 x 1.037 x 1.150 x 1.150 = $137,143