Key Facts About FIAs vs. IUL Insurance

- Fixed index annuities and indexed universal life policies are different types of insurance products that accumulate value tied to an investment index and can provide a death benefit.

- Fixed index annuities are primarily designed to accumulate value and provide income in retirement. They are best suited for people who want to safeguard their financial security after they stop working.

- IUL insurance accumulates cash value and leaves a death benefit. This product suits pre-middle-aged people who want to provide income for their dependents.

Similarities Between Fixed Index Annuities and Indexed Universal Life Insurance

Fixed index annuities and indexed universal life (IUL) insurance are both insurance products. Many insurance companies sell both IUL policies and fixed index annuity contracts, and state insurance commissioners regulate both products.

IUL insurance and fixed index annuities also share some features. As Mark Stewart, an in-house CPA for Step by Step Business, told Annuity.org, both products can include a death benefit and offer tax-deferred growth on investment earnings.

A fixed index annuity, also called an indexed annuity, is a type of annuity whose growth is tied to the performance of an equity market index such as the S&P 500. Similarly, an indexed universal policy earns interest credits based on the performance of an external investment index.

Both fixed index annuities and IUL insurance policies have some level of guaranteed growth. Even if the linked index performs poorly, both types of contracts are guaranteed to earn a fixed rate of interest.

Fixed index annuities and indexed universal life are more different than they are similar. While neither should be expected to produce equity-like returns, fixed index annuities are meant primarily as an income vehicle, while all forms of life insurance are not.

Differences Between Fixed Index Annuities and Indexed Universal Life Insurance

Although they are both insurance products that grow in value based on an external index, fixed index annuities and IUL insurance have a few major differences. To begin with, the two products serve different purposes in your financial planning.

The primary purpose of any annuity is to grow your savings with some level of guarantee or protection before converting the premium into a stream of income you can’t outlive. Financial planners often recommend annuities as a strategy for supplementing retirement income from other sources such as Social Security or a 401(k).

Conversely, an IUL policy mainly serves to provide income for your beneficiaries after you die. An IUL policy doesn’t pay out until the policyholder dies, while annuities distribute income payments throughout an annuitant’s lifetime.

Another difference between the two products is how customers must pay the premiums. Many insurance companies require the entire value of the fixed index annuity to be paid in a single premium. IUL insurance, however, requires policyholders to pay smaller premiums on a regular basis. The insurer divides each premium payment and allocates the funds toward the cost of the insurance (that is, the death benefit) and the policy’s cash value.

IUL policies often have flexible premiums, meaning you can adjust how much you have to pay within certain limits and keep the policy in force. Fixed index annuities usually have a minimum premium amount, often around $10,000, and a maximum premium that could be up to $1 million.

Additionally, Stewart pointed out that “annuities generally lack a cash value component, whereas IUL insurance can accumulate cash value over time.” This means an IUL policyholder could borrow money against their policy up to its cash value. However, no such provision exists for annuities.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

How To Choose Between a Fixed Index Annuity and Indexed Universal Life Insurance

To decide whether a fixed index annuity or an IUL policy is right for you, you must first understand your personal financial goals.

An indexed annuity’s principal protection and guaranteed income option make it appropriate for generating a reliable income source in retirement. “Annuities are typically designed for the closer stages of retirement,” Sherice Mangum, a life insurance broker and owner of Fire Financial Partners, told Annuity.org.

Because their growth is tied to an equity market index, fixed index annuities might suit customers somewhat younger than the average annuity buyer. Many fixed index annuity purchasers have a decade or more before they plan to retire, so their premium has time to ride out market fluctuations.

Annuity customers can use it to leave a death benefit to an heir, but this is a secondary perk. If your main goal is to leave some income to your beneficiaries, an annuity might not be the most appropriate product, as they can be considerably more expensive than life insurance policies.

An indexed universal policy, on the other hand, is designed to provide a death benefit to the policyholder’s heirs. As a form of life insurance, IUL offers the features of a flexible death benefit and a cash value that will steadily grow with an index.

The growth of that cash value means IUL policies can be beneficial for customers younger than the typical indexed annuity customer. “IULs are typically better for the younger crowd because they have time to accumulate growth for personal or business needs,” Mangum explained. Universal life insurance buyers are typically between 30 and 60 years old.

An indexed universal life insurance policy balances risk and return in a way that’s unique to universal life insurance. If you want a policy with a greater return potential than standard universal life without the risk of full market participation that comes with a variable universal life policy, then indexed universal life insurance might be the best solution.

You may determine that both fixed index annuities and IUL insurance have a place in your financial plan because their purposes are so different. Mangum advised that having both an annuity and IUL insurance can be a solid strategy. “Have the IUL for accumulation to help cover future taxes and the estate, [and have] an annuity to shield [against] running out of money in retirement,” Mangum told Annuity.org.

Evaluating your risk tolerance is another crucial component of choosing either of these products. The risk of an IUL policy is less than that of a variable universal policy but more than other types of life insurance that aren’t tied to an index’s performance.

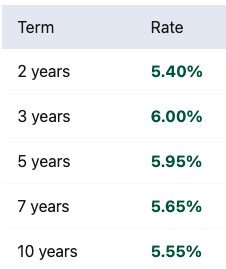

Calculate Your Returns Based on Today’s Best Rates

Similarly, an indexed annuity carries less risk than a variable annuity, as it has principal protection and a guaranteed minimum interest rate. However, because index returns cannot be predicted with 100% accuracy, this type of annuity holds some risk compared to a fixed-rate annuity.

Editor Hannah Alberstadt contributed to this article.