What Does “Refinancing an Annuity” Mean?

When homeowners refinance their mortgage, they replace one loan with another in exchange for better terms. Annuities work similarly, allowing you to exchange your current contract for a new one that better suits your situation.

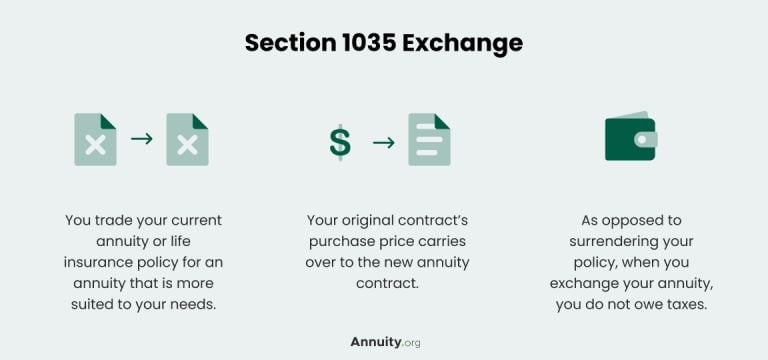

Annuity refinancing is typically done through a Section 1035 Exchange, which allows you to move from one annuity to another without triggering taxes.

It’s essential to note that your original contract may be subject to surrender charges of up to 7%, which can reduce the purchase price. In cases where a surrender charge applies, your original premium is not guaranteed to fully transfer to the new policy. However, many insurance companies offer a bonus to help offset these surrender charges.

However, with a 1035 exchange, you can at least avoid the tax consequences, which could be up to 10% if you are not yet 59 ½ years old. Plus, you won’t owe income tax on any profit or annual return you have made on the annuity.

How the Process Works

Refinancing an annuity is a fairly straight forward process, but it does involve several specific steps in order to protect your money and avoid unnecessary costs.

- Review your current contract. Before making any moves, look closely at your existing annuity. Identify surrender charges, rider values, and guaranteed benefits you’d lose.

- Compare new options. Once you know what you may sacrifice, evaluate whether the benefits of your new contracts outweigh those trade-offs. Consider updated rates, fee structures, and available riders.

- Request a 1035 exchange. A 1035 exchange is the IRS-approved way to move from one annuity to another without triggering taxes. Your new insurer handles the transfer directly.

- Finalize your new contract. Once the transfer is complete, you’ll receive the new documents for your annuity contract. Confirm that the terms, riders and payout options align with your goals.

Most states require a free-look period usually lasting 10-30 days which allows you to cancel your new contract for a full refund. This is your safety net if you feel uncertain about your decision. However, after this window closes, surrender charges may apply if you exit early.

Reasons People Refinance Their Annuities

Refinancing an annuity is rarely about chasing the newest product. For most people, it is due to their financial situation, retirement goals or changes in the annuity market. The most common reasons people refinance include more competitive rates, lower fees, new features, a change in payout structure or new financial goals

More Competitive Rates

Interest rates fluctuate, so older annuity contracts may not reflect today’s lower yields.

Refinancing has two main benefits:

- You can move to a fixed annuity or MYGA with higher guaranteed interest.

- You can capture better lifetime income payout rates if you’re closer to retirement.

Example: A retiree with a 2% fixed annuity may refinance into a 4.5% MYGA, nearly doubling their guaranteed growth without the additional risk.

Lowering Fees

Variable annuities can come with layered fees for management, riders, and mortality charges. Refinancing may help you:

- Reduce or eliminate annual fees by moving to a fixed or indexed annuity.

- Simplify your contract so more of your money works for you.

What users say: “The product the agent steered me towards was a fixed annuity and was a life saver for me… the agent knew what my needs were and met them.” — Bob Y.

New Features

Older annuities may lack modern riders. These features can provide peace of mind, especially if health or family needs have shifted. A refinance could add:

- Long-term care riders that help cover nursing home or assisted living costs.

- Inflation protection riders that increase your income as costs rise.

- Lifetime withdrawal benefits for predictable income, even if your funds runs out.

- An enhanced death benefit leaving more value for your heirs.

Change in Payout Structure

Life circumstances evolve, so your payout structure may need adjustments over time:

- Switch from deferred growth to an immediate income annuity for retirement paychecks that begin right away.

- Move from a single-life payout to a joint-and-survivor annuity to guarantee continued spousal income after you are gone.

- Opt for a period-certain feature to protect beneficiaries.

Example: A couple in their early 60s refinanced from a single-life annuity into a joint annuity so that both partners would receive income for life.

New Financial Goals

Certain major life events, such as these, typically spark the need for a review of old annuity contracts:

- Divorce may shift financial priorities or require splitting assets.

- An inheritance or windfall can allow for the consolidation of funds into a stronger product.

- Changing risk tolerance may mean you prefer to transition from growth-oriented products into safer, income-guaranteed options as retirement approaches.

Refinancing isn’t always about what’s wrong with your current contract. It is more often a matter of whether your annuity is still a good fit for your retirement lifestyle today, not just when you first bought it.

Old Annuity vs. New Annuity

| Reason to Refinance | Old Annuity | New Annuity (Refinanced) | Real-World Impact |

|---|---|---|---|

| Rates | Originally locked in at 2% | Current MYGA at 4.5% | Doubled guaranteed growth without extra risk |

| Fees | Variable annuity with 2–3% annual fees | Fixed or indexed annuity with little to no fees | More money goes toward income, not charges |

| Features | No riders available | Riders for inflation, long-term care, or lifetime withdrawals | Added protection against rising costs or health events |

| Payout Structure | Single-life payout only | Joint-and-survivor or period-certain options | Ensures spouse or heirs continue receiving benefits |

| Life Alignment | Bought before divorce, retirement or a windfall | Updated to match a new family or financial situation | Greater flexibility and peace of mind |

How Refinancing Affects Beneficiaries

When you refinance an annuity through a 1035 exchange, you’ll need to name beneficiaries on the new contract. This is also a good time to review how your annuity will pass to heirs.

Spouse vs. Nonspouse Beneficiaries

Spouse Beneficiary

A surviving spouse typically has the most flexibility. In many cases, they can continue the annuity as their own, maintain tax-deferred growth, or receive ongoing income through a joint-and-survivor payout option.

Nonspouse Beneficiary

Non-spouse beneficiaries have more restrictive options. They usually must withdraw the funds within a set time period and pay income taxes on gains as distributions are received. They generally cannot assume ownership of the contract.

If leaving money to heirs is important, refinancing may allow you to add a death benefit rider or choose a payout structure that better protects your spouse or beneficiaries.

Get Guidance Before You Decide

Refinancing an annuity can be a smart move — but not always. Therefore, it is highly recommended that you consult a professional financial advisor who can help you navigate surrender charges and IRS tax laws, as well as the contract fine print of your contract.