When you purchase an annuity, you enter into a contractual agreement with an insurance company. This involves you making a one-time premium payment (or a sequence of payments) for which the insurance company commits to provide you with periodic payments in the future. Annuitization is the phase where these periodic payments begin.

Once you decide to annuitize your annuity, you’re essentially giving up all the premiums you’ve paid to the insurance company in exchange for these periodic income payments. While this can provide a stable income stream for life, it also means giving up a degree of control over your money.

Key Facts About Annuitization

- Annuitization is a process that converts an annuity into a series of income payments.

- The amount, frequency and length of time for the payments are spelled out in the annuity contract and can be difficult or impossible to change.

- Annuitization can provide a lifetime income stream, but you give up a degree of control over your money.

- The decision to annuitize should be based on individual financial circumstances and retirement goals.

Unfortunately, misunderstandings around annuitization fuel common misconceptions about annuities and can lead to negative consequences for retirees. Annuitization can serve a key role in a retirement strategy, but it’s not right for everyone. Annuitants should fully understand the implications, benefits and potential downsides before choosing to annuitize their annuity.

How Does Annuitization Work?

When you annuitize, you set up a systematic payment plan with your insurance company. The insurer calculates the annuity payout amount based on various factors such as your age, life expectancy and projected interest rates. The resulting payout rate determines the amount of income you receive over the payment period. Your annuity contract outlines the amount, frequency and duration of these payments.

The income payments from an annuity are only partially taxable. They consist of both taxable income and the nontaxable return of your principal amount. Once your entire principal has been repaid, you’ll continue to receive the same income each month, but these payments will be fully taxable.

Once you elect to annuitize your contract, you cannot reverse your decision. You also won’t be able to withdraw or otherwise access any of the money in the annuity besides what you receive in income payments.

“While annuitization is beneficial, it also means sacrificing a considerable amount of control,” Jonathan Summers, a senior annuity consultant at Senior Market Sales, told Annuity.org.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

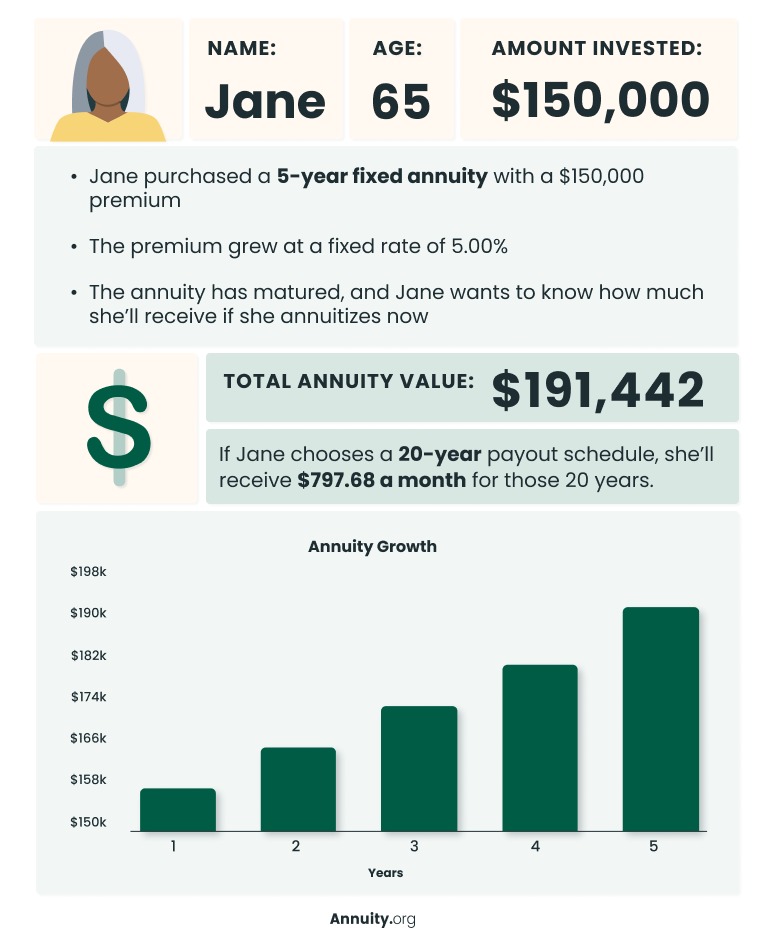

Annuitization Example

The Role of Annuitization in Retirement Planning

Many financial experts suggest using a portion of retirement savings to purchase income annuities as a replacement for pensions, which have long been a means of guaranteeing regular income in retirement but are increasingly rare today. The lifetime income provided by annuity products can help protect retirees from outliving their savings and enable them to spend their remaining funds as they see fit without worrying about making the money last.

However, annuitization isn’t very popular among retirees due to the loss of control over their assets. In fact, only about 5% of all annuities sold in the United States in 2018 were annuitized. This means that the majority of annuity owners prefer to take permissible withdrawals from their annuities without annuitizing them.

If an investor is reluctant to annuitize a financial contract and does not foresee doing so until forced, I seriously question whether the annuity makes sense for him or her. Obviously, this investor has adequate sources of income and a very long investing horizon. This tells me he or she is assuming a lot of opportunity cost by not investing in higher-yielding debt instruments and/or growth-oriented securities.

Pros and Cons of Annuitization

Pros

- Guaranteed income for life

- Protection against longevity risk

- No risk of losing money to market volatility

Cons

- Cash value of purchase is gone after annuitization

- Accumulation phase ends and cash value can no longer increase

Like any financial decision, annuitization has its pros and cons which should be considered when you’re planning for retirement. On the positive side, it provides a guaranteed income for as long as the annuitant wishes, which can even be for life.

This stable income can help cushion your retirement savings against the effects of inflation, according to licensed life insurance agent Brad Cummins. “Having such an investment alternative within your portfolio highly decreases the risk of losing out huge bucks due to volatility and other factors,” Cummins said.

On the downside, once an annuity is annuitized, the cash value of the purchase is gone. There is no way to access the underlying principle or get a refund, making the investment illiquid. Also, once an annuity enters the annuitization or payout phase, the accumulation phase stops. This means the cash value of the annuity can no longer increase according to the investment strategy detailed in the annuity contract.

Also know that, barring any added riders or added contract provisions, an income annuity’s payments cease upon the death of the annuity holder and potentially his or her spouse. “You can name a secondary annuitant, but ultimately if you die early, and your secondary annuitant dies early, you probably left money on the table,” Certified Financial Planner™ professional Kevin Lao told Annuity.org. “However, this is a small price to pay to guarantee a lifetime of income without worrying about what the stock market is doing daily.”

Get Your Free Guide to Annuities

Annuitization Payout Options

When you annuitize your contract, you have several options for how to receive your income payments. Most annuitants opt for a lifetime payment schedule, which guarantees payments for as long as they live. With a lifetime payout, the amount you receive is dictated by your life expectancy. The longer you’re expected to live, the lower your payments will be.

Other options include a fixed amount, also known as a systematic withdrawal system, or a fixed period, sometimes called period certain annuitization. This means you choose a period of time to receive the payout, usually between 10 and 20 years. If you pass away before this period ends, the remaining payments go to your named beneficiary.

When To Annuitize

The decision to annuitize is highly personal. According to Summers, most annuity contracts specify a deadline for deciding when to annuitize. The deadline is flexible, typically by the age of 95. If you haven’t annuitized by then, the contract automatically annuitizes. Some contracts prohibit annuitization for the first five years, he added.

Determining when is the best time to annuitize is dependent on your unique situation. “There is no best time for everyone,” said Elle Switzer, director of annuity product management at CUNA Mutual Group. “Annuitization is generally a retirement strategy to guarantee income for life, but not all consumers will decide to start income right when they retire.”

Alternatives to Annuitization

While annuitization offers a guaranteed income stream, it’s not the only option for those looking to leverage their annuity funds. As Summers told Annuity.org, many of the new developments in annuities over the course of the last decade have been focused on offering alternatives to avoid the annuitization of annuities.

- Lump Sum Payment

- After the surrender period, you can choose to cash out your annuity. This means you’ll receive the funds in your account, along with any earnings, as long as you’re at least 59 ½ years old.

- Roll Over the Money

- Some annuities offer a grace period after maturity to decide what to do with the money. Leaving the money in the annuity may trigger a new contract, restarting the surrender period.

- Systematic Withdrawals

- Systematic withdrawals offer flexibility by allowing annuity owners to determine the amount and frequency of withdrawals, maintaining control over their assets. This method also provides potential for the annuity’s value to grow over time, offering a hedge against inflation.

- Living Benefit Riders

- Living benefit riders, such as guaranteed minimum income benefits or guaranteed lifetime withdrawal benefits, provide a guaranteed income stream without annuitizing and protect against market volatility. These riders also offer flexibility since the owner can typically start or stop the income stream as needed, and may have the option to take additional withdrawals.

Here are a few alternatives:

Is Annuitization Right for You?

Deciding whether to annuitize is a personal decision that depends on your unique financial circumstances and liquidity needs.

Here are some important factors to consider:

- Financial Objectives: Do you need a guaranteed income for life, or is access to your underlying funds more important?

- Total Value of Your Assets: If you have enough savings to keep some funds liquid, it may make sense to annuitize a portion of your assets.

- Tax Treatment: Annuities grow tax-deferred, meaning the funds are not taxed as income until they are withdrawn. If you withdraw the funds all at once, there will be a larger tax payment due.

- Flexibility: Annuitization eliminates flexibility.

Annuitization is a powerful tool for ensuring a steady income during retirement. However, it’s not a one-size-fits-all solution. Consider your financial goals, risk tolerance and liquidity needs before deciding to annuitize your annuity. Always consult with a financial advisor to make the best decision for your unique situation.

Worried About Your Retirement Savings?

Frequently Asked Questions About Annuitization

Fully annuitized means you have converted the entire value of your annuity contract to a stream of regular, periodic payments. This is often an irreversible decision.

You can usually annuitize at any age after buying an annuity, but some annuity providers don’t allow you to annuitize for at least five years after buying an annuity.

This depends on the terms of your contract. Most annuity contracts set a deadline for deciding whether to annuitize, usually around age 95. If you pass the deadline, the annuity typically annuitizes automatically.