Fitting an Annuity Into Your Retirement Plan

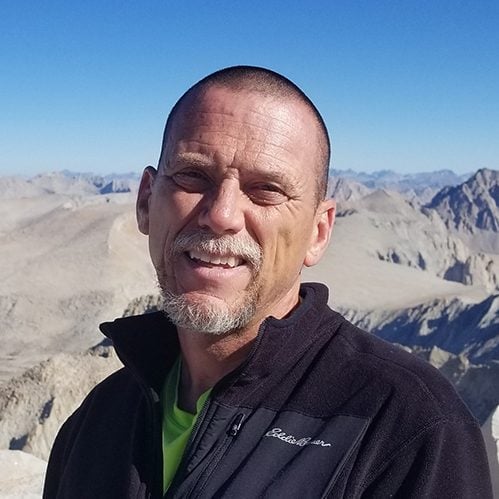

In the second part of our conversation with James Philpot, who holds a doctorate in Finance, we discuss how annuities may fit into your retirement portfolio.

Philpot is the director of the Financial Planning Program and an associate professor in the finance and risk management department at Missouri State University in Springfield.

He puts his risk management background to work in this episode with steps you can take to make sure your retirement savings are set to ride uncertain financial times.

In this episode, you’ll learn:

- What people with annuities should know about inflation and their existing annuity.

- Why the current economic climate is a good reason to reassess your planned retirement budget and investment plans.

- How to respond to sudden market changes when you’re planning for the long term.

- What questions you should ask about annuities when doing a personal reassessment of your retirement savings.

James Philpot

James Philpot

Guarantee financial freedom with an annuity.

Guarantee financial freedom with an annuity.