Key Takeaways

- Taxes collected by federal, state and local governments are crucial for financing infrastructure, emergency services, education, and welfare programs.

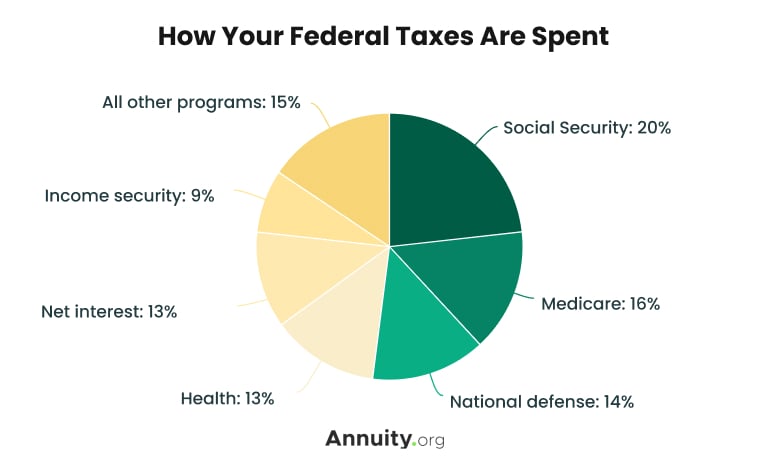

- A significant portion of federal tax revenue is allocated to national defense, Social Security, Medicare, and various social programs, while the federal government often spends more than it collects.

- Common taxes include income taxes, payroll taxes, capital gains taxes, and property taxes, each targeting specific sources of revenue and supporting different aspects of government spending.

What Are Taxes, and Why Are They Important?

Taxes are mandatory contributions you are required to make to local, state and federal governments. Taxes in the U.S. come in a wide variety of forms, including income taxes, property taxes and sales taxes.

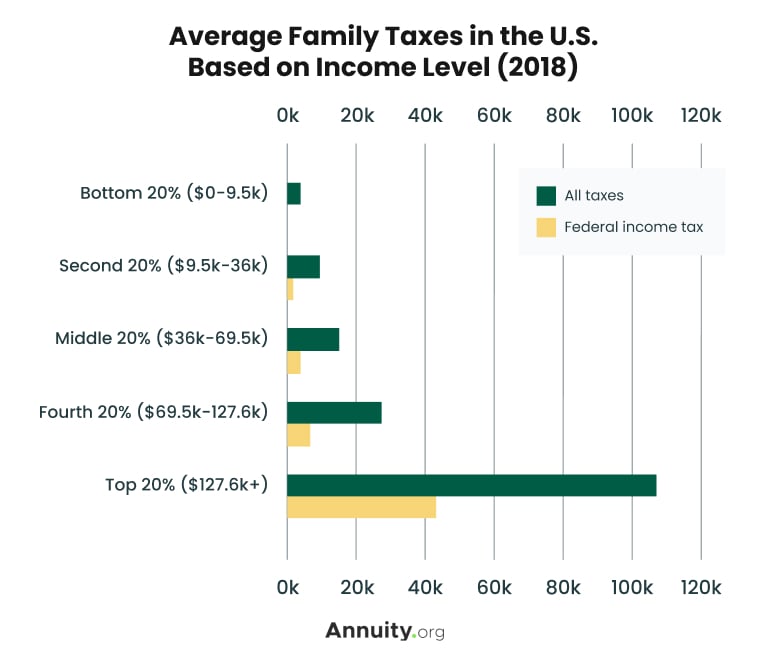

In 2024, Americans paid $2.1 trillion in income taxes off a gross adjusted income of $14.8 trillion, according to the . Taxes are important not only because of how much of your income they take but also because of what you get in return.

Governments rely on taxes as their main revenue source. This money funds public programs, work and services. Taxes provide the money necessary to maintain your local and national infrastructure, such as emergency and welfare programs.

Different levels of government — federal, state and local — pay for different public services, but sometimes they overlap. For example, all three levels of government pay for different costs associated with roads, education and some other services.

Let’s Talk About Your Financial Goals.

How Are Federal Taxes Used?

Most of the taxes collected by the federal government go to national defense, Social Security, Medicare and other health or social programs.

The federal government routinely spends more money than it collects from taxes and other forms of revenue. As of April 2025, the national debt — the amount of money the federal government owes — was more than $36.2 trillion, according to the Peter G. Peterson Foundation.

How Are State and Local Taxes Used?

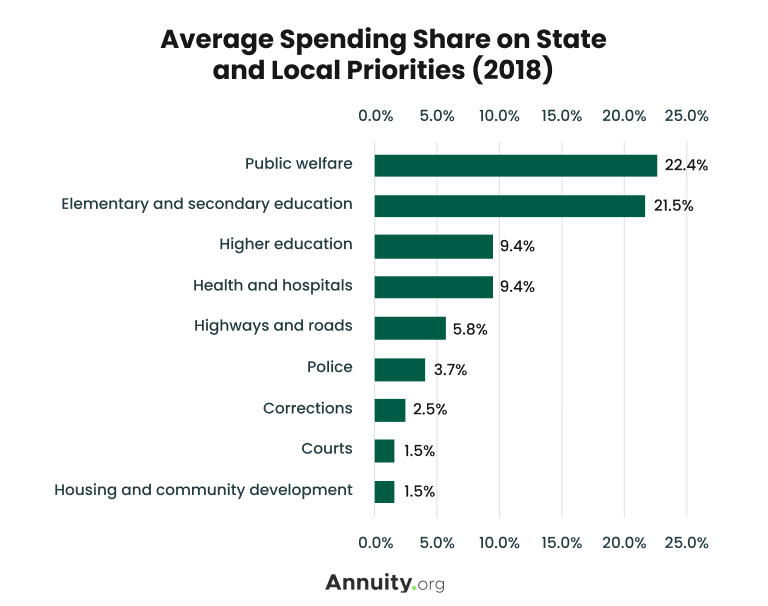

State spending varies depending on many different factors, from population to overall wealth to the amount of taxes they collect. But education is the single biggest expense for every state in the union.

State and local taxes often go to the same service — public schools are a good example. The state may fund part of the costs, and counties, cities or school districts spend local taxes on them as well.

Combined spending on elementary, secondary and higher education accounts, on average, for nearly a third of state and local expenditures, according to the nonprofit Urban Institute.

Public welfare costs include most Medicaid costs while police spending also includes money spent on courts and correctional facilities in the Urban Institute analysis.

State and local governments spent roughly $4.44 trillion in 2020, according to U.S. Government Spending.

What Are the Most Common Types of Taxes?

Taxes come from a variety of sources. The nature of what is taxed and the method required to collect the tax often determine the different types of taxes. Understanding taxes can help you better manage your personal finances.

Taxation on annuities is a bit different; here, taxes aren’t due until you start to receive income payments from your annuity.

- Income Taxes

- These are taxes you pay on your earned income — salaries, wages, tips and commissions — and unearned or investment income such as interest and dividends. The federal government, 42 states and several local governments collect some type of income taxes.

income such as interest and dividends. The federal government, 43 states and several local governments collect some type of income taxes. - Payroll taxes

- Payroll taxes include Social Security and Medicare taxes. These are taken out of your paycheck to pay for these specific programs.

- Capital gains taxes

- Capital gains taxes are taxes on the profit you make when you sell investments such as stocks, bonds or real estate.

- Corporate taxes

- These are taxes states and the federal government place on a corporation’s profits. Companies pay taxes based on corporate income minus the cost of making the goods and services sold, administrative costs, and other operating expenses.

- Estate taxes

- Estate taxes are the taxes you have to pay to transfer property upon your death. They are based on the fair market value of everything you own or have an interest in at the time of your death.

- Property taxes

- Property taxes typically apply to the value of your real estate, but they may also apply to business inventories or big-ticket items such as cars, boats or other vehicles that you own.

- Sales taxes

- Sales taxes are taxes on retail products you purchase based on a set percentage of the cost of the items. These are typically used by state and local governments.

- Tariffs

- Tariffs are taxes placed on products imported from other countries. The tariff is paid by the consumer buying the product, not the foreign country or importer from which it came.

Common Types of Taxes

Read More: Federal Tax Brackets

Let’s Talk About Your Financial Goals.

How to File Your Taxes

For most Americans, the term “filing your taxes” applies to your federal and state income tax returns. It means providing details about your income and other information to make sure that you pay the amount of taxes you owe.

You can file paper returns or file your income taxes online. You can file your taxes yourself, you can pay a tax preparer to do the work for you or you can use a digital filing service.

- Gather your paperwork

- Make sure you have your W-2 form from each employer you had in the previous year, other earning and interest statements (forms 1099 and 1099-INT) and receipts for all charitable donations, medical expenses and business expenses if you are itemizing deductions on your return.

- Choose your filing status

- Your filing status is based on whether you are married and can be affected by the amount you pay toward household expenses.

- Decide how to file

- The IRS recommends that you use tax preparation software and e-filing digitally. This tends to be the quickest, easiest and most accurate way to file your tax returns, but you can file a paper return if you want.

- Decide if you are itemizing or taking a standard deduction

- Deductions reduce the amount of income taxes you have to pay. The standard deduction varies depending on your age, filing status and several other factors. It changes each year. Itemized deductions are a better route if they add up to more than your standard deduction. You may also not be eligible for a standard deduction in some circumstances.

- Pay taxes if you owe any

- If you overpaid your taxes through withholding or other payments in the previous year, you’ll get a . However, if you owe taxes, the IRS has several methods for paying your taxes, including mailing a check, using a debit or credit card, and paying by a direct bank transfer.

- Pay your taxes before the deadline

- It’s important to remember that you have to file your taxes and pay any amount due before the annual deadline to avoid interest and penalties. For federal income taxes, this is typically April 15 of each year, but it may vary depending on whether the 15th falls on a weekend or certain state holidays. It was extended by three months in 2020 during the COVID-19 pandemic.

6 Steps to File Your Federal Income Tax Return

Typically, income tax filing software will let you do your state income tax returns as well — without having to reenter all the information from your federal income tax return.

Deadlines for filing your state income tax return vary from state to state. You should check with your state to determine when your state forms are due.

How Do You Pay Other Taxes?

Other taxes are collected in other ways and can vary from state to state and from tax to tax.

For example, local governments may send you an annual bill for property taxes, or you may have to pay property taxes whenever you renew your driver’s license or car tags.

Sales taxes are collected whenever you buy something — simply added to the price rung up at the cash register. Tariffs are added to the price of an item before you buy it.

What Are Tax Deductions?

Tax deductions are personal or business expenses that reduces how much of your income is subject to tax. These typically fall into two categories: standard and itemized deductions.

The federal income tax standard deduction reduces your taxable income based on your filing status, age, whether you are blind and how many dependents you have.

Itemized deductions are different expenses you’ve had that the law lets you claim to reduce your taxable income.

Typical Itemized Deductions

- State and local income or sales taxes

- Real estate taxes

- Personal property taxes

- Mortgage interest

- Losses due to a federally declared disaster

- Charitable contributions

- Part of your medical expenses

- Part of your dental expenses

Source: Internal Revenue Service

Tax filing software typically walks you through potential deductions. Tax preparers can also help you find deductions. If you are preparing your own tax return, you should use IRS Schedule A (Form 1040), Itemized Deductions when filing your taxes.

Join Thousands of Other Personal Finance Enthusiasts