Key Takeaways

- Mass affluent individuals have between $100,000 and $1 million in liquid assets and an annual household income exceeding $75,000 a year.

- They are one of the largest consumer segments in the country, making up 28% of U.S. households.

What Is Mass Affluent?

Mass affluent refers to individuals in the largest group of affluent consumers in the nation. These households would be considered part of the middle class but have above-average income and an above-average amount of liquid assets, which are not tied up in land, houses or cars.

There is some overlap between the mass affluent and the upper middle class, but these two terms are not synonymous. The determining factor to classify someone as upper middle class is how much income they make, whereas mass affluent people are generally defined not only by income but by their liquid assets.

Criteria To Be Considered Mass Affluent

The criteria to be considered mass affluent include the person’s income and amount of liquid assets. Individuals with mass affluence have liquid assets valued between $100,000 and $1,000,000.

Mass affluent individuals have an annual household income exceeding $75,000 a year. These are usually workers in white-collar careers with significant savings and retirement funds. They likely have a decent understanding of wealth management and personal finance.

In addition to net worth criteria, there are certain economic and demographic characteristics that can be associated with mass affluent people. Over 40% of mass affluent people in America are part of the baby boomer generation, according to data from Customer Communications Group.

Mass affluent people are more likely to be married, and many of them have post-graduate degrees and maintain retirement accounts. They are also differentiated from other wealth segments by their propensity to travel. Certified Financial Planner™ R.J. Weiss categorized mass affluent individuals by the lifestyle they can afford. “Mass affluent individuals are typically financially secure and able to afford a very comfortable lifestyle,” said Weiss, “but they’re not buying multimillion-dollar homes or top-end cars.”

What’s the Difference Between Mass Affluent and High Net Worth?

The biggest difference between mass affluent and high-net-worth individuals is the amount of assets they’ve amassed. High-net-worth individuals have even more assets than the mass affluent.

A high-net-worth individual has over $1 million in liquid assets. Someone with at least $5 million in assets is classified as a very-high-net-worth individual, and those with at least $10 million in assets are ultra-high-net-worth individuals.

Once someone crosses the threshold of having a high net worth, they may be able to access special privileges from financial institutions. These privileges could include investing in private equity funds and becoming a shareholder in promising startups.

How Many People Are Considered To Be Mass Affluent in the United States?

According to Datos Insights, there are 36.7 million mass affluent households in the United States.

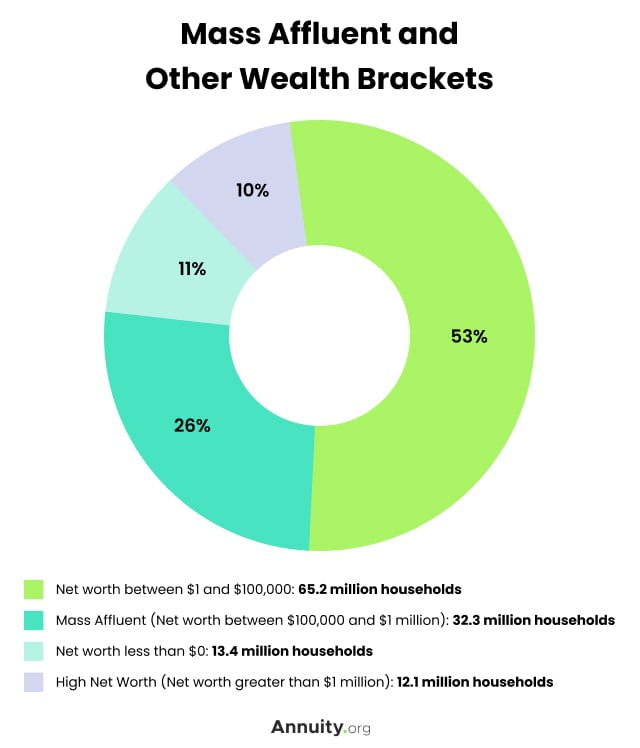

This means that mass affluent households make up one of the larger wealth brackets in the country, comprising 28% of total U.S. households.

In contrast, households with a net worth greater than $1 million, represent roughly 10% of the country. The largest net worth bracket comprises households with a positive net worth under $100,000, roughly 65.2 million households. Finally, 13.4 million households in America have a negative net worth.