Fixed index annuities are often described in extremes—either as a safe alternative to market investing or as a product with too many limitations to be worthwhile. In reality, FIAs sit somewhere in the middle.

They are not designed to maximize returns, nor are they meant to replace traditional investments entirely. Instead, FIAs offer a specific trade-off: market-linked growth without the risk of market losses.

Understanding the trade-off is key to evaluating the true pros and cons of a fixed index annuity.

Advantages of Fixed Index Annuities

The benefits of fixed index annuities are best understood through how they are structured. Each advantage flows directly from the way FIAs are designed to balance growth and protection.

Protection From Market Losses

One of the most compelling advantages of a fixed index annuity is principal protection. When the underlying market index declines, your annuity value does not decrease due to market performance.

This means:

- Your account value is shielded from market downturns

- Losses in years like 2008 or 2020 do not reduce your credited value

- Market volatility does not derail long-term planning

For many retirees and near-retirees, avoiding large losses is just as important — if not more important — than capturing every possible gain.

The obvious benefit to fixed index annuities is the downside risk protection. These annuities offer investors protection from market losses while still offering (limited) growth potential connected to the underlying market index.

Opportunity for Market-Linked Growth

While FIAs protect against losses, they still allow your annuity to earn interest based on market performance. When the linked index increases, interest may be credited to your account.

Growth is not direct participation in the market. Instead, it is calculated using predefined rules such as caps, participation rates, or spreads. These rules limit upside but make growth more predictable and controlled.

This structure allows FIAs to offer growth potential that traditional fixed annuities cannot — without exposing your savings to direct market risk.

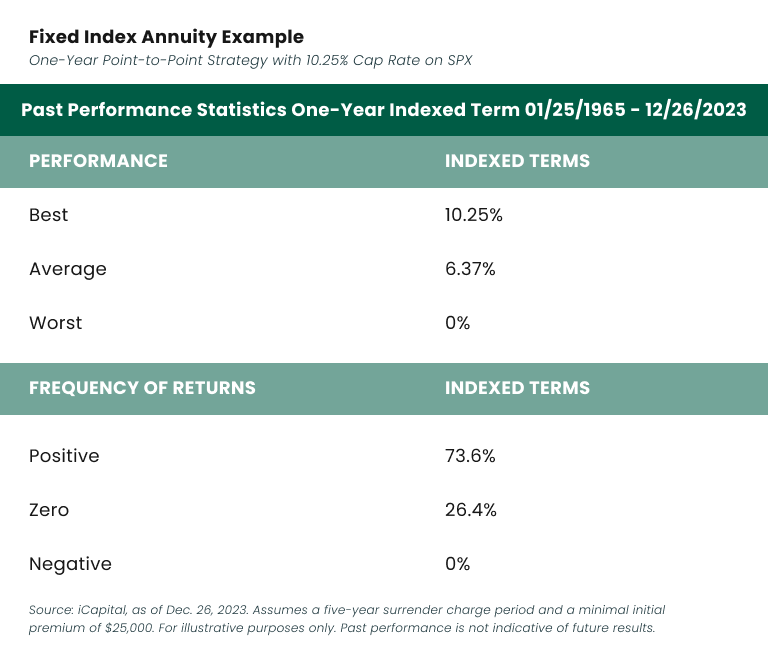

A Real-World Example of Fixed Index Annuity Performance

This example shows how a fixed index annuity might have performed over time, based on historical market data. It illustrates how market-linked growth works in practice, including both the upside potential and the built-in protection against losses.

In this example, a one-year index annuity strategy with a 10.25% cap is applied to decades of S&P 500 market history. When the market went up, the annuity earned interest up to the cap. When the market declined, the return was 0% — not a loss. Over time, this approach resulted in steady, moderate growth while avoiding market-driven declines, illustrating the core trade-off of fixed index annuities: giving up some upside in exchange for downside protection.

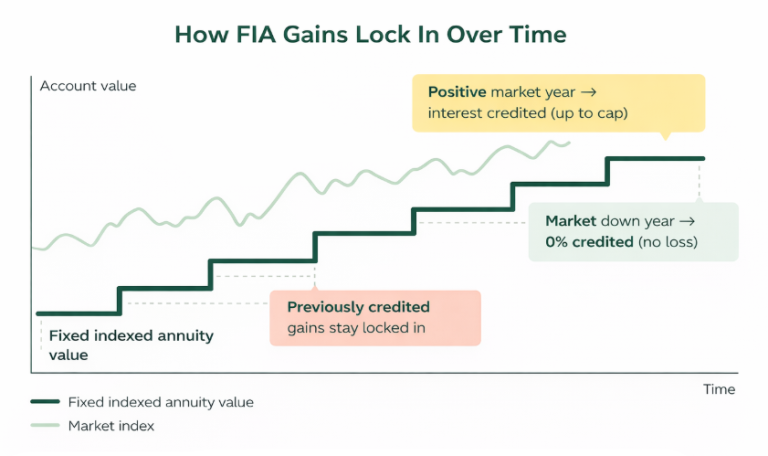

Gains That Lock In Over Time

When a fixed index annuity earns interest, that gain doesn’t float up and down with the market. It’s added to your account value and permanently locked in.

Think of growth as steps, not waves.

In years when the market rises, your annuity may step up (within its limits). In years when the market falls, your account doesn’t step down — it simply stays where it is and waits for the next opportunity to move higher.

Over time, this creates a stair-step pattern: Upward movement in positive market years, flat periods during downturns and no loss of previously credited gains.

This lock-in effect is a key reason fixed index annuities appeal to investors who value steady progress and protection over unpredictable market swings.

Tax-Deferred Accumulation

Like other annuities, fixed index annuities grow on a tax-deferred basis. You do not pay taxes on interest earned until you withdraw funds.

Tax deferral can be especially valuable for individuals who have already maximized qualified retirement accounts, expect lower taxes in retirement, or want more flexibility in managing future taxable income.

Optional Guaranteed Income Features

Many FIAs offer optional riders that can provide guaranteed lifetime income. These riders are not automatic and typically come at an additional cost, but they can play a meaningful role in retirement income planning.

For some retirees, FIAs serve as a bridge between growth-oriented savings and predictable income — helping supplement Social Security or pension benefits.

Tradeoffs to Consider Before Choosing an FIA

The advantages of fixed index annuities come at a cost. The same features that provide protection and stability also introduce limitations.

Understanding these tradeoffs is essential before deciding whether an FIA aligns with your goals.

Limited Upside Compared to Direct Market Investing

Because FIAs limit how much of the market’s gain you receive, they are unlikely to outperform the stock market during prolonged bull markets. This is an intentional design choice, trading unlimited upside for downside protection.

These growth limits are commonly applied through caps, participation rates, or spreads. Each method controls how much of the index’s gain is credited, and understanding how these mechanisms work is essential when comparing fixed index annuity products.

These limits are the price paid for downside protection. Investors seeking maximum long-term growth may find these constraints restrictive.

See How Much You Could Earn With Today’s Best Rates

Liquidity Restrictions in Early Years

Most fixed index annuities include surrender periods, during which withdrawals above a certain amount may trigger fees.

While many products allow limited penalty-free withdrawals each year, FIAs are best suited for money that can remain invested long term.

They are not ideal for:

- Emergency savings

- Short-term financial needs

- Investors who anticipate frequent access to principal

Product Complexity and Variability

Not all fixed index annuities work the same way. Crediting methods, caps, participation rates, and rider options vary widely between products and insurers.

This complexity means:

- Product comparisons matter

- Terms can change at renewal

- Understanding the fine print is essential

For investors who prefer simplicity, this learning curve can be a drawback.

Not Designed for Short-Term Goals

FIAs are long-term financial tools. Their benefits become clearer over time as gains lock in and market volatility subsides.

Using an FIA for short-term objectives can result in frustration, missed opportunities, or unnecessary fees.

Growth Potential vs. Certainty

At its core, choosing a fixed index annuity isn’t about deciding whether the product is good or bad. It’s about deciding which tradeoff you’re more comfortable living with.

Some investors are willing to accept full exposure to market losses in exchange for unlimited upside. Others prefer to forgo some growth potential in exchange for protection against market declines. Fixed index annuities are designed for people in the second group — those who value certainty, predictability, and protection, even if it means forgoing every market gain.

A Real-World Example

Imagine two people retiring at the same time, each with $300,000 set aside for long-term growth.

One invests directly in the stock market. In strong years, their account grows quickly. But during market downturns, their balance declines—sometimes sharply—and they must wait for the market to recover before feeling financially secure again.

The other chooses a fixed index annuity. In strong market years, their growth is capped, so they don’t capture every gain. But when the market declines, their account value doesn’t fall. The balance stays the same, and any prior gains remain intact.

Neither approach is “right” or “wrong.” The difference comes down to priorities: one accepts volatility in exchange for unlimited upside, while the other gives up some growth potential for greater certainty and protection.

Fixed index annuities are neither a universal solution nor a product to dismiss outright. When used appropriately, they can play a valuable role in a diversified retirement strategy.

The key is aligning expectations with reality. FIAs are designed to provide controlled growth, downside protection, and long-term stability — not to outperform the market.

Evaluating the pros and cons through that lens can help determine whether a fixed index annuity supports your broader retirement goals.