With the variety of types, riders, payout options, interest-crediting methods and tax treatments, annuities are intricate products. But don’t overlook these reliable, income-generating insurance products because of their complexity. Learning how to compare different annuity offerings can help you make informed decisions about your finances and retirement.

Key Facts About Comparing Annuities

- To compare different types of annuities, first identify the benefits you hope to get from the annuity.

- Common reasons for purchasing an annuity include principal protection, lifetime income, legacy creation and long-term care costs.

- Each annuity type serves a specific purpose, such as fixed annuities for principal protection or immediate annuities for a guaranteed income stream.

- Once you select an annuity type, compare the offerings of that annuity among different insurance companies.

Comparing Annuity Benefits

Discussing the different annuity types means delving into their available features. You have options regarding premiums, payout schedules, investment types, add-on features and death benefits.

But before you decide which annuity features you want, you must determine what your objectives are for purchasing an annuity to begin with. A good financial advisor will lead with this question and help you find the right fit for your needs.

Every financial instrument and investment vehicle in your portfolio should serve your individual long- and short-term goals. If you know what you want and are realistic about your limits, you can narrow down your options and make a decision that’s right for you with the help of a knowledgeable expert.

Working with an advisor who is willing to show you all annuities is very important. Many times, advisors will only compare two or three annuities and leave out others that may be more suitable for you. When in doubt, get another opinion or ask if they can give you access to an annuity calculator so you can assess what is available before making a decision. The only way to properly compare your options is to be able to see everything that’s for sale in the marketplace.

The Most Common Annuity Objectives

Understanding what your objectives are – and how an annuity can help – can play a large role in comparing different options. Some of the most common objectives that annuities can help to achieve include:

- Premium protection

- Income for life

- Legacy (or bequests)

- Long-term care cost coverage

These objectives resonate with retirees and people nearing retirement, and annuities are uniquely suited to help reach them.

Different annuities also attack these objectives in different ways.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

Annuities for Different Objectives

When comparing annuities, it helps to understand how each kind might support the different financial objectives you may have.

Fixed annuities are the least complicated and least expensive type of annuity. They are based on bonds and other fixed-income products and intended to provide a guaranteed income stream with fixed payment amounts. They are reliable and predictable, which makes them a great fit for those seeking the benefit of income security without regard for capital appreciation.

Conversely, variable annuities offer the potential for growth tied to the market but lack the reliability and security of fixed annuities. Variable annuities are based on subaccounts that may include mutual funds, money market funds and other investments. They are more suitable for people who are willing to trade the predictability of a guaranteed income stream for the possibility of capital appreciation.

A third investment classification, the indexed annuity, functions as a hybrid with income payments determined by a stock index. Indexed annuities offer upside potential with protection against market risk.

If you know your goal is income security in retirement, then your risk tolerance — the degree of volatility you’re willing to bear from the annuity — is naturally going to be low. This is your limit, and it should dictate your decision to purchase a fixed annuity.

Or your objective might be to grow your retirement savings, and you might be more comfortable with the risks of market exposure. In that case, you may opt for a variable annuity that has higher growth potential along with some downside risk.

But the investment type isn’t the only characteristic that determines how a specific annuity works. The other major categorizations of annuities relate to when the premium gets converted into a payment stream and when those payments begin.

Annuities are categorized based on various characteristics, and it’s common for them to fall under multiple classifications, which can sometimes be confusing.

Income annuities convert a lump-sum premium into a stream of income immediately after the purchase, while deferred annuities undergo an accumulation phase before annuitizing. An income annuity can begin paying out within a year of purchase (an immediate income annuity) or payments can be delayed (a deferred income annuity).

Again, to compare these options you must consider your objectives and the benefits you want from the annuity. Immediate annuities might be more helpful for someone who values simplicity or who needs income right away. Someone who wants to grow their savings might prefer a deferred annuity.

Other Annuity Comparison Considerations

Thinking about the benefits of different annuity options can further help you narrow down the type of annuity you want to purchase. But before you sign any contracts, you’ll likely look at a few different products of the type you’re interested in that are offered by different annuity providers.

Even when comparing the same type of annuity, there is a great variety among offerings from different providers. Some providers might offer more generous annuity rates or charge fewer fees than others. When it’s time to shop around for an annuity, it’s wise to work with a professional financial planner who can help explain options for your situation.

“Consult a third-party, trusted advisor who can offer an unbiased opinion of your suitability for an annuity product,” Stephen Kates, a Certified Financial PlannerTM professional, told Annuity.org. “Different companies offer different benefits and rates, so even if an annuity fits your needs, you may need to shop around to find the right one.”

When comparing contracts for the same kind of annuity available from different providers, evaluate features like:

- Administrative fees

- Age range required to be issued an annuity

- Bailout provisions

- Expense charges

- Withdrawal rules and fees

- Minimum premium required to purchase

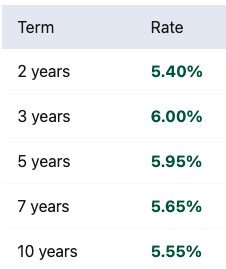

Calculate Your Returns Based on Today’s Best Rates

Frequently Asked Questions About Comparing Annuities

You can determine the best type of annuity to get by deciding what benefits you value most from an annuity and looking for a product that offers those benefits.

If you’re a conservative investor who wants to set up guaranteed income in retirement while protecting your principal investment, an annuity may be the right choice for you.