Although some annuity regulations are relatively uniform across the states, it is important to understand the nuances of an annuity purchase in your state.

Key Facts About Annuities by State

- Rules and taxes for annuities change from state to state, so it’s important to know your state’s rules when buying.

- An annuity available in one place might not be in another, or it could offer different benefits and prices.

- A free look period lets you cancel an annuity, and rules for protecting customers change among states.

When buying an annuity, it’s crucial to think about the state you’re purchasing it in. Even if the provider is licensed in several states, each state has different regulations and taxes for annuities.

You can usually only buy annuities from insurance companies licensed in your home state. But you might have more choices if you have homes in multiple states.

State Annuity Regulations

Annuities, which are classified as insurance products, are regulated by each state’s insurance commission. As a result, the rules governing annuity products may vary significantly from one state to another.

Although there are federal annuity regulations, financial planners who sell annuities must be licensed by individual states to sell these products and follow state insurance annuity regulations.

While state insurance commissioners regulate all annuities within their state, variable annuities and RILAs fall under the category of securities. These products are subject to additional oversight by the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).

According to the National Association of Insurance Commissioners (NAIC), some states require suitability assessments for annuities. This means that annuities can only be sold to customers if the annuity is appropriate for them. However, it is essential to note that not all states have this requirement for annuities.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

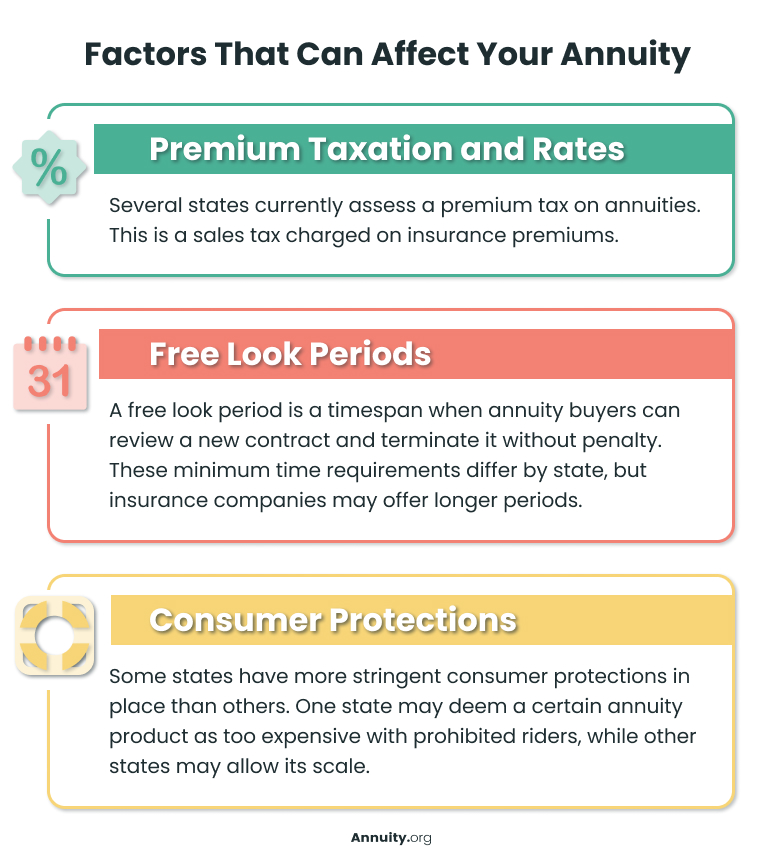

Premium Taxation and Rates

State premium taxes are akin to sales taxes on insurance premiums for policies issued in that state. Only a handful of states assess state premium taxes on annuities, according to the NAIC.

States usually apply premium taxes on annuities when you purchase a new immediate annuity or when you annuitize an existing deferred annuity. Premium taxes can reduce the value of your annuity if you are taxed at the time of purchase. It’s essential to know how the premium tax might affect you if you’re considering buying an annuity.

At least eight states and Puerto Rico levy a state premium tax on annuities, with rates between 1% and 3.5%.

State Premium Taxes on Annuities

| State | Annuity Premium Tax Rate |

| Nevada | 3.5% |

| California | 2.35% |

| Colorado, Maine | 2% |

| South Dakota | 1.2% (on the first $500,000) |

| Florida, Puerto Rico, West Virginia, Wyoming | 1% |

In addition, although Texas does not levy a premium tax on annuities, it may impose an annual maintenance tax on annuity premiums. The maximum amount for this tax is 0.4% per year, which fluctuates yearly.

Free Look Periods

You have a certain amount of time after signing up for a variable annuity, typically 10 days or more, called the free look period. This period lets you get more information about the annuity and ensure it fits your needs.

You can cancel your contract without being charged any fees during this time. You will also get a refund of the money you paid. The refund amount may change depending on how well your investment options are doing.

The free look period’s length may differ depending on the state where you purchased your annuity. For example, in California, if you are an older buyer of an annuity, you can have a free look period of up to 30 days.

The free look period in an annuity contract is important to understand. I had a client who canceled his annuity contract days after purchasing it because he had put too much premium in. He got his money back within two weeks and had another contract in place thereafter. It is important to supply the insurance company with the cancellation request in writing as well as return the physical copies of the contract to get the return expedited.

Consumer Protections

Annuity consumer protection regulations can vary between states.

Some products may be allowed in certain states but prohibited in others due to factors like cost or terms. For example, in New York, provisions to protect consumers may limit their annuity options.

Some states may allow annuity products that offer more growth potential for buyers, but these come with a higher level of risk.

The NAIC has created an Annuity Suitability Model Regulation to ensure that producers and insurers prioritize consumers’ needs and financial interests above their own. This regulation enforces a “Best Interest Standard of Care.”

As of 2024, 41 states have adopted language focusing on four key elements to protect consumers: care, disclosure, conflict of interest and documentation.

Requirements for Annuity Providers in the Annuity Suitability Model

- Know information about the consumer’s financial situation, insurance needs and financial goals.

- Understand the available recommendation options and select a reasonable option that effectively addresses the consumer’s financial situation, insurance needs and financial goals.

- Communicate the basis of the recommendation to the consumer.

- Disclose their role in the transaction, the products they are licensed and authorized to sell, the source of their compensation, and any conflicts of interest.

- Document in writing any recommendation and the justification for such recommendation.

Source: National Association of Financial Advisors

States also provide coverage for consumers in the unlikely event that your annuity company cannot cover your payments.

State Guaranty Associations

If an insurance company goes bankrupt, state guaranty associations are there to offer some degree of protection to consumers. All states, including Puerto Rico and the District of Columbia, have guaranty associations that protect policyholders within specified limits if an insurance company becomes financially unstable.

They may cover a portion or all of the annuity’s value instead of the annuity owner losing everything. However, coverage varies from state to state and is based on the present value of the annuity.

Your state’s guaranty association is in your state of residence and may have different rules from other states’ associations. However, in some cases, the guaranty association responsible may be determined by other factors, such as the insurance company’s license to operate in a particular location.

Remember that while some state guarantees exist, federal agencies such as the FDIC or SIPC do not insure annuities.

Overwhelmed by Safe Retirement Options?

Examples of Annuity Considerations by State

California

California applies a premium tax of 2.35% to annuities and a 2.5% penalty on early distributions from annuities. The state’s guaranty association offers coverage for up to $250,000 for present-value annuities.

People who purchase annuities in California are entitled to a free look period of 10 days. But buyers 62 and older have a free look period of 30 days.

Learn More About Annuities in California →

New York

Although New York is not known for being a tax-friendly state, it does not charge a premium tax on annuities. New York offers better safeguards for those purchasing annuities than many other states.

These rules affect the range of products insurance companies offer, the benefits available to consumers and the companies that provide them.

New York’s state guaranty association offers coverage of up to $500,000 for a single annuity, with the total range for all insurance products capped at $1,000,000. Additionally, a free look period of 10 to 30 days is mandatory, and any annuity sold by mail must have a 30-day free look period.

Learn More About Annuities in New York →

Florida

Florida tends to have fewer annuity restrictions in place than states like New York or California, which have more intense regulations. Looser regulation can sometimes mean that consumers may need more protection in Florida.

The state’s annuity premium tax is 1%, and consumers can receive benefits coverage of up to $250,000 from the Florida Life & Health Insurance Guaranty Association. Florida also requires a standard 14-day free look period, or 21 days if you’re 60 or older.

Learn More About Annuities in Florida →

Let’s Talk About Your Financial Goals.

What Annuity Products Are Available in Your State?

The availability of annuity products may differ depending on your state. This is because individual states regulate annuities, and annuity companies must meet specific licensing requirements for each state. These conditions affect which annuities they can sell in each state.

Therefore, certain annuity products may be available in some states but not in others.

It’s essential to compare annuity offerings from multiple providers to make an informed decision when buying an annuity. Make sure to check annuity company credit ratings to ensure they are financially stable.

Consider seeking advice from a knowledgeable financial advisor to understand all available options and address any questions related to your state’s regulations and benefits.