What Are the NAIC’s Suitability Guidelines?

NAIC suitability guidelines set basic standards for insurers or agents who recommend annuity products to consumers. The guidelines ensure that the recommended products fit consumers’ financial needs.

Key Facts About NAIC Suitability Guidelines

- The NAIC suitability guidelines set requirements for agents and insurers to only recommend annuities that fit a consumer’s financial needs.

- Insurers and agents who adopt NAIC Model Regulation guidelines must take a four-hour educational course before selling annuity products.

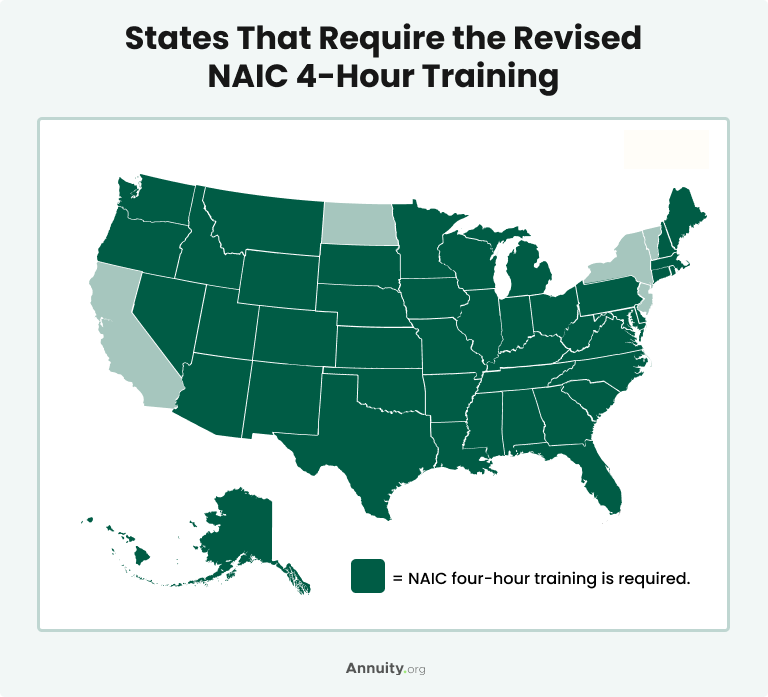

- Forty-eight states have implemented the current NAIC Model Regulation guidelines as of February 2025.

Before recommending an annuity product, the agent or insurer is required by the suitability guidelines to gather specific information on the consumer, including age, annual income, planning timeline, risk tolerance and financial goals.

The Suitability in Annuity Transactions Model Regulation has provided the framework for these guidelines since its adoption in 2003. It was revised with enhanced standards in 2020.

As a consumer, you must perform your own due diligence to ensure that an annuity you choose to purchase is the best option for you. But agents and advisors that sell annuities are also required to follow certain guidelines and receive training that relate to the suitability of their recommendations.

As of February 2025, 48 states have adopted the revisions to the NAIC Model Regulation, including the following:

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Mexico

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Source: NAIC

The implementation of the revisions is currently pending in New Jersey.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

What Training Requirements Are Mandated by the NAIC?

Insurers or agents in states that have adopted the NAIC Model Regulation must complete a general four-hour annuity training course. The course must be administered by an educational vendor approved by the department of insurance.

The NAIC outlines training requirements for the course in Section 7 of its revised Model Regulation. According to the NAIC, “a producer shall not solicit the sale of an annuity product unless the producer has adequate knowledge of the product to recommend the annuity, and the producer is in compliance with the insurer’s standards for product training.”

Established annuity agents in states that adpot the revised 2020 NAIC Model Regulation can complete an additional one-hour supplemental course instead of retaking the full four-hour course. However, they must do so within six months of the revisions taking effect in their state.

New agents must complete a four-hour course with the updated information included in the curriculum.

The Model Regulation states that annuity-specific training must include the following information:

- Annuity types and classifications

- How to identify the parties of an annuity

- Product-specific annuity contract features and how they affect the consumer

- Income taxation of qualified and non-qualified annuities

- Primary uses of annuities

- Appropriate standards of conduct, sales practices, replacements and disclosure requirements

Are There Other Certifications Required To Sell Annuities?

Agents should be licensed in the state they sell the annuities in. The licensing process can vary by state, but most agents engage in product-specific and carrier-specific training, along with continuing education or CE courses, to be knowledgeable about their business lines.

Worried About Your Retirement Savings?

What Are the Annuity Suitability Training Requirements by State?

The states that have adopted the NAIC’s Model Regulation mandate the four-hour annuity suitability training, while other states have different rules in place — or no statewide requirements at all.

As a consumer, you may want to verify the level of training your insurer, agent or broker has completed before making your purchase.

Source: Quest CE

State requirements may change as new annuity regulations are adopted. Verify all requirements with your state or governing board.

- California

- Eight hours of training is initially required, plus a four-hour CE training course every two years, thereafter.

- New Jersey

- New Jersey is currently in the process of adopting the revisions to the Model Regulation. The required updates to its four-hour training course are in progress.

- New York

- New York hasn’t enacted the revised suitability regulations. Its Emergency Regulation 187 provision doesn’t set specific hourly requirements, placing the responsibility to train agents on the insurers.

Still Not Sure Where to Begin?

NAIC Annuity Suitability Training Requirement FAQs

Per the 2025 update, 48 states adopted model revisions for annuity best interest training, according to the NAIC.

Editor Tori Roughley contributed to this article.