What Does a Mortgage Note Do?

Mortgage notes give lenders security during the lending process, as without the note, borrowers would not be legally bound to repay the loan. Once the note has been signed by both parties, it is legally binding and permits the lender to take legal action if the borrower defaults on the loan.

Key Facts About Mortgage Notes:

- A mortgage note contains important legal information related to your property purchase loan, such as the interest rate and consequences if you fail to repay your loan.

- You can get a copy of your mortgage note by checking the county recorder or reaching directly to the lender.

- Owners may sell their mortgage note to buyers in the secondary mortgage note industry, receiving a lump sum of cash in exchange.

Once the loan has been repaid in full, the mortgage note gives the borrower full control of the property.

A mortgage note serves as protection to the lender—to protect their interest in a property. Should the borrower fall behind on the agreed upon mortgage note payments, the lender has the right to recourse by foreclosing or taking back the property.

Information in a Mortgage Note

The following information will be included in a mortgage note:

- The exact amount borrowed, which is the total amount you owe on the mortgage

- Interest rate

- Down payment amount

- Your full legal name

- Name of the lender

- The repayment plan (including the start date and maturity date of the loan)

- Consequences if you fail to repay your loan

Source: Credit Union of Southern California

“With the agreement, the borrower is promising that they will repay the loan in accordance with the terms set forth in the note. A mortgage note also outlines any additional fees and interest rates that are associated with this loan agreement.” Michael Branson, CEO of All Reverse Mortgage, Inc. told Annuity.org.

Who Holds the Mortgage Note?

The mortgage note is held by your original lender, which can change after the official sale.

Lenders are allowed to sell mortgage notes to buyers in the secondary mortgage note industry. Mortgage notes are sold in exchange for a lump sum of cash. The lender can sell the whole note or a portion of the payments for a partial sale.

If a mortgage note is sold, the details of the contract will remain the same. The only difference will be who the payments go to.

Turn your mortgage note into cash you can use now

Different Types of Mortgage Notes

Mortgage notes document the terms of the mortgage, which means they are determined by the type of loan the borrower is taking out. As the loan types differ, so do the terms in the note.

Below are the most common loan types and how they impact the mortgage note details.

- Secured Loan

- A secured loan is a loan that uses assets as collateral. “Interest rates are often lower for these types of notes because the lender is able to take possession of the collateral in case of default,” according to Branson. Secured loans may also have a longer payment term. The lender takes less financial risk with a secured loan and can make a better deal with the borrower.

- Private Loan

- “This type of mortgage note is known as a private loan note and often requires higher interest rates and fees in order to compensate for the lack of security,” Branson told Annuity.org. A private loan may occur when the lender owns the property outright. In this case, the lender is less regulated and can set up the note to their liking.

- Institutional Loan

- An institutional loan is a loan from a traditional mortgage lender or bank. These loans are heavily regulated, so the note must follow standard interest rates and payment terms. Mortgage loan terms from an institutional loan are typically 15, 20 or 30 years, according to the Consumer Financial Protection Bureau.

The most common types of home loans include:

What Does a Mortgage Note Look Like?

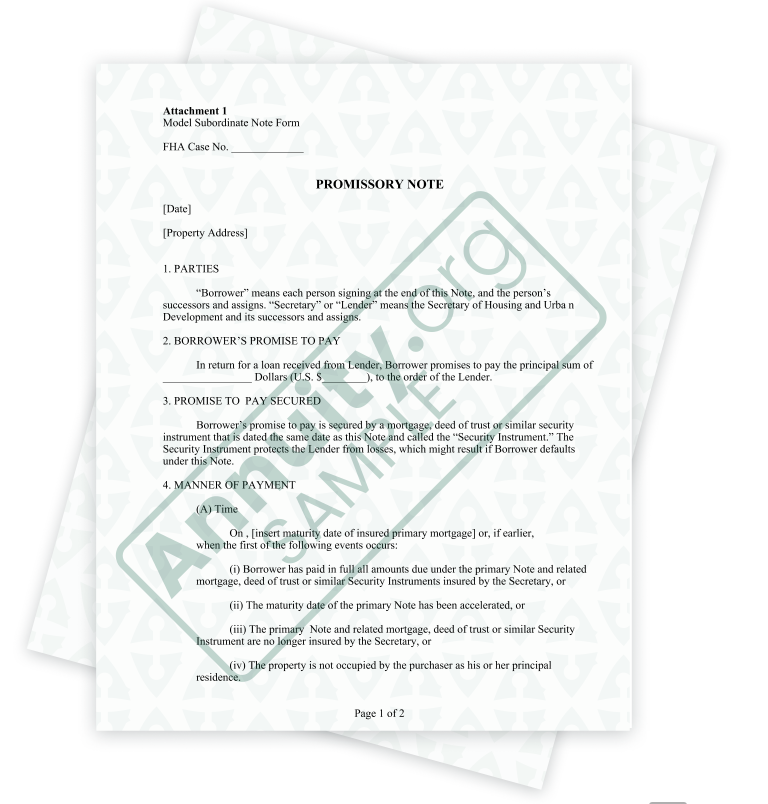

Mortgage notes are usually titled as a note, borrower’s note, promissory note or mortgage note. Document titles will help you differentiate between your mortgage note and other loan forms, such as the closing disclosure or loan estimate.

The mortgage note is typically two to three pages in length, according to Alliant National. Our example below can help you identify your mortgage note.

According to the U.S. Department of Housing and Urban Development, mortgage notes include the amount you owe, interest rate, payment due dates, the length of time for repayment and where the payments are to be sent. The note also contains a section outlining any consequences if the terms of the note are broken.

Read More: Promissory Note vs. Mortgage Note

How To Get a Copy of Your Mortgage Note

The lender is legally required to give you a copy of your mortgage note once signed. However, you could request another if you lost your original copy.

Reach out to the lender, and they can send you another copy of your mortgage note. Under the Federal Servicer Act, loan servicers are required to respond to qualified written requests regarding information related to the loan.

You can also check with your county’s official record department. Many documents are filed in public record, including mortgages, deeds and other land attachments. You may be able to go directly to the county website to request copy of your mortgage note.

Turn your mortgage note into cash you can use now

Mortgage Note FAQs

A mortgage note is an essential legal document that breaks down the lending terms of your mortgage repayment plan. Without a mortgage note, your repayment plan would lack structure and the lender would have no legal protection if you failed to meet payment expectations.

If you are the lender, you hold ownership of the mortgage note and have full rights to sell it. Mortgage notes can be sold in exchange for a quick lump sum on the secondary market.

Mortgage notes are also known as promissory notes.