What Is Property Tax?

Property taxes are a form of tax that is based on the percentage of the value of the property you own. Property taxes typically apply to your home, land or other real estate. In addition, 43 states also collect personal property taxes on tangible property such as your car or boat.

As a result, property taxes are divided into two categories — real estate taxes and tangible property taxes.

- Real estate tax

- Real estate taxes are property taxes levied on the value of privately owned land and buildings. These tend to be the most common type of property taxes and tend to generate the most revenue for the government.

- Personal property tax

- Personal property taxes refer to tangible property — things you own that can be touched and moved. Furniture, business equipment, business inventory, machinery, automobiles and other items may be taxed in different jurisdictions.

Types of Property Taxes

Property taxes accounted for 31.9 percent of state tax collections and 72.1 percent of local tax collections in the U.S. in 2017, according to the Tax Foundation. States and local governments collected a combined $547 billion in property taxes in 2018, according to the Urban Institute.

The owner of the property taxed is responsible for paying the property tax to the jurisdiction where it’s located. Failure to pay your property taxes can result in harm to your personal finance in the form of fines, interest or — in some cases — having your home or other property seized and sold to satisfy your tax debt.

Read More: Investing for Beginners

What Do Property Taxes Pay For?

Local governments — such as cities, counties and school districts — tend to be most dependent on property taxes for revenue. So property taxes pay for a large share of local services.

- Schools

- Property taxes are a major source of funding for public schools in all 50 states — accounting for 82 percent of all local school funding according to the National Center for Educational Statistics. Local property taxes pay to build and maintain schools and to help pay for teacher salaries.

- Public safety

- Equipment and salaries for local police, fire departments and emergency services and other public safety services depend on property taxes.

- Public spaces

- Property taxes are a source of funding for public parks, ball fields, jogging and bike trails and other public recreational facilities.

- Sanitation

- Trash and recycling pickup as well as water and sewage services are paid for in part with property tax collections. Home or other property owners pay fees for these services, but these fees are essentially a type of property tax.

- Streets and roads

- Property taxes help fund city streets, county roads and other local transportation infrastructure.

Where Most Property Taxes Go

Property taxes vary greatly between jurisdictions and are often pooled together from state, county, city and other jurisdictions to pay for overlapping services.

Let’s Talk About Your Financial Goals.

How Are Property Taxes Calculated?

Property taxes are calculated by the local government where the property is located. The calculation is based on the value of the land and of the buildings on it, but the exact way it’s calculated can vary based on where you live.

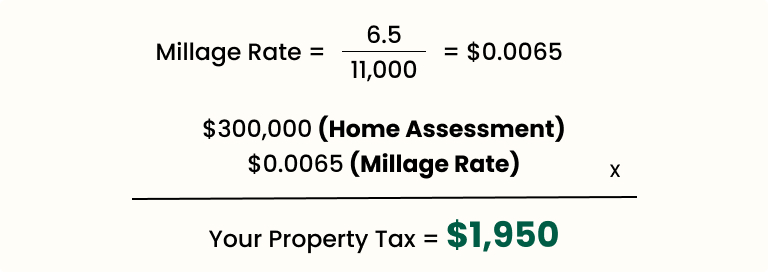

The calculation depends on your millage rate and your property’s assessment. It is also affected by any property tax exemptions for which you may qualify.

- Millage rate

- The millage rate is the tax rate for your property tax. A mill is a unit of monetary value with each mill equal to one-tenth of one cent. For each $1,000 in property value, each mill equals one dollar.

- Property assessment

- The property assessment is how the taxing government sets a value on your property. Governments order routine appraisals to assess the changing value of land and property. Some governments will tax the full value of your property, others will only tax a percentage of the value.

- Property tax exemptions

- Most jurisdictions give property tax exemptions — a form of tax breaks — to different demographic groups to ease their tax burden. Any exemptions for which you qualify can reduce your property tax liability.

Elements of Calculating Your Property Tax

The taxing authority uses these three factors in a formula to calculate your property tax liability.

This is how your taxes would be calculated if your home was assessed at $300,000 and your local millage rate was 6.5 percent.

How Property Tax Exemptions Work

Property tax exemptions help make it easier for more people to afford home ownership. They reduce your property tax liability and in some cases, may completely eliminate your property tax bill.

They typically apply to specific demographic groups and vary widely depending on where you live.

- Disability exemption

- People with disabilities may qualify for different types and amounts of exemptions. Rules vary depending on where you live, so you should check with your local taxing authority.

- Homestead exemption

- Homestead exemptions provide a discount on your property tax if you live in a property full-time. You can’t get this exemption for vacation homes, rental property you own or an investment property.

- Religious exemptions

- Property that serves as a church, religious or charitable institution may qualify for a religious property tax exemption depending on where you live.

- Senior exemption

- Senior exemptions are intended to help older residents living on fixed incomes. You typically have to be a certain age and live in the property full time to qualify.

- Veterans and service member exemptions

- Some jurisdictions offer varying exemptions for active duty service members and veterans. Disabled veterans may also qualify for specific exemptions. These can range from a reduction in your property tax bill for people serving on active duty to fully eliminating the property tax on your home.

Examples of Property Tax Exemptions

Property Taxes by State

All 50 states levy property taxes, but the property tax burden varies widely from state to state and even within states.

States With the Highest Property Taxes Per Capita (2017)

| State | Per Capita Taxes |

| 1. District of Columbia | $3,496 |

| 2. New Hampshire | $3,307 |

| 3. New Jersey | $3,276 |

| 4. Connecticut | $3,020 |

| 5. New York | $2,902 |

States With the Lowest Property Taxes Per Capita (2017)

| State | Per Capita Taxes |

| 47. Kentucky | $831 |

| 48. New Mexico | $792 |

| 49. Arkansas | $740 |

| 50. Oklahoma | $730 |

| 51. Alabama | $582 |

Source: Tax Foundation

There are also 23 states (plus the District of Columbia) that do not levy a personal property tax on automobiles — typically the most expensive tangible property tax for most Americans. Another 13 states do not collect property taxes for senior homeowners age 65 or older.

23 States With No Property Tax on Cars

- Alaska

- Delaware

- District of Columbia

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Maryland

- New Jersey

- New Mexico

- New York

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Washingon

- Wisconsin

13 States With No Property Taxes for Seniors

- Alabama

- Alaska

- Florida

- Georgia

- Hawaii

- Mississippi

- New Hampshire

- New York

- South Carolina

- South Dakota

- Texas

- Washington

When Are Property Taxes Due and How Do You Pay Them?

Property taxes are due at different times in different states. How you pay them also depends on where you live.

The National Property Tax Group, an alliance of property tax consultants, maintains an online tax calendar you can use to find out when property tax bills are issued, when your property tax bills are due and the deadline to appeal issues with your property taxes.

How you pay can also vary depending on where you live. Some counties collect property taxes once a year, others collect quarterly payments.

- Payment in full

- You can pay your property taxes in full by the due date from a personal account. Some jurisdictions will allow you to spread these payments over quarterly or semi-annual payments to make the payment easier.

- Escrow account

- In some cases, you may be able to set up an escrow account tied to your mortgage payment. You’ll make a higher monthly mortgage payment with a portion going into an escrow account to cover the property tax. The mortgage provider will then forward the money in this account to the taxing authorities when the property tax is due.

Property Tax Payment Methods

You can check with your state tax agency to find out where you should pay your property taxes. The National Association of Counties has an online county explorer tool that can help you find contact information for your county’s tax assessor and tax collector offices.

Read More: Federal Tax Brackets

How to Dispute Property Taxes

You can dispute your property tax bill through an appeal. The process differs depending on where you live.

You cannot challenge the millage rate — that’s a fixed rate in your jurisdiction. But you can question the assessed value of your property or why a property tax exemption you applied for was rejected.

If you’re disputing the amount of your property assessment, you’ll need to contact your county tax assessor’s office. Ask about how your property assessment was prepared.

You’ll then need to research the amount paid for recent property sales in your neighborhood or area and see how the sale prices compare to your property’s assessed value. You may be able to ask your realtor to find these prices for you.

If you are questioning why you were denied an exemption, you may have to show proof to the assessor’s office that you are qualified for the exemption.

In either case, you will have to act quickly. There is a deadline for appealing a property tax bill or assessment.

This can be as little as 30 days after you receive your bill. You will need to check with your taxing authority to find out what that deadline is and what process you need to follow for an appeal.