How Participation Rates Work

Participation rates determine how much of an index’s positive performance is applied to your annuity’s interest credit.

Fixed index annuities are linked to the performance of market indices like the S&P 500®, Dow Jones Industrial Average or Nasdaq Composite. While they offer protection from market losses, they also limit upside potential — and participation rates are one of the main ways this is done.

Here’s how it works:

- The provider measures the change in the index over a defined period (often using the point-to-point method).

- If the index increases, the participation rate is applied to that gain.

- The resulting amount is what gets credited to your annuity.

Participation Rate Example

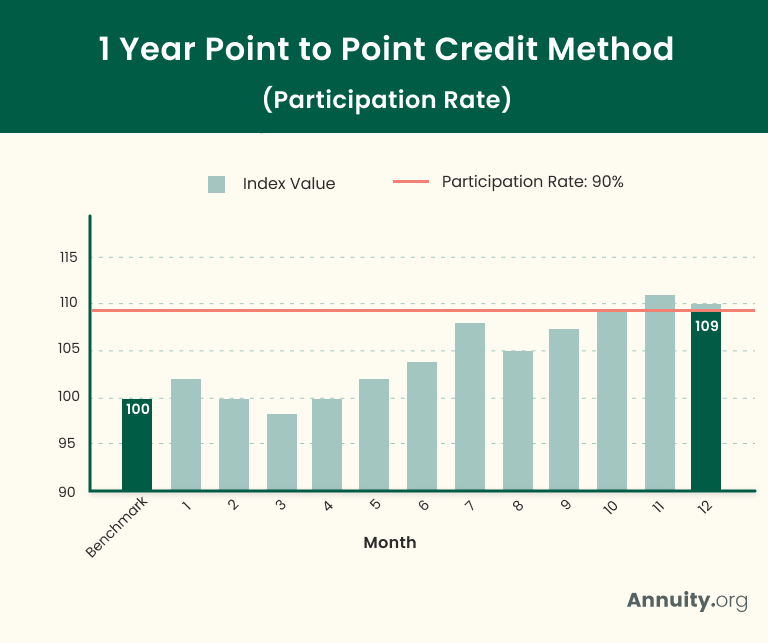

Participation rates are applied after the index’s performance is measured. This simple step-by-step example shows how index gains translate into credited interest:

- 1. Measure the index performance

- The index increases by 10% over the crediting period.

- 2. Apply the participation rate

- Your annuity has a 90% participation rate, meaning you receive 90% of the index’s gain.

- 3. Credit the interest

- 9% interest is credited to your annuity for the year (90% of the index’s 10% increase).

If the index gained 20%, the same participation rate would credit 18%. If the index is flat or negative, no interest is credited, but your principal is protected from loss.

Why Participation Rates Exist

Participation rates exist so providers can limit upside gains while continuing to protect annuity owners from market losses.

To do this, providers must:

- Cover administrative costs

- Manage market risk

- Generate a sustainable profit

Because providers absorb market losses, they limit upside through pricing features such as participation rates, interest rate caps and rate spreads.

These features work together to balance growth potential with principal protection.

Are Participation Rates a Bad Thing?

Participation rates are not inherently a bad thing but rather a trade-off that limits upside growth in exchange for principal protection.

When you choose a fixed index annuity with a participation rate, you’re agreeing to:

- Give up some upside potential

- In exchange for protection from market losses

This makes FIAs especially attractive for investors who prioritize stability, predictability and retirement-income planning over maximizing market returns.

If your goal is to capture every bit of market upside, traditional equities or variable annuities may be a better fit. But if protecting what you’ve already built matters more, participation rates can play a valuable role.

Protecting your money from losses late in life can be a hugely satisfying benefit, but 75% of the time, the market is positive, so you’ll see more up years than down. I find that preparing investors for their muted positive returns is the most important part of entering into an indexed annuity. During a terrible year, it’s easy to feel good about loss protection, but it can be harder to compare what would have been in the up years. This can be self-defeating. Align your investment targets with only what you need to earn to meet your goals, not what you could have earned and you’ll be more satisfied and less stressed.

Participation Rates vs. Other Crediting Methods

Participation rates are just one way providers manage growth. Others include rate spreads and rate caps.

Cap Rate

Sets a ceiling on how much interest your annuity can earn in a given period, even if the index performs higher.

Example: Your index earnings are 10%, but your actual return is capped at 6%.

Participation Rate

Determines the percentage of the index’s gain that’s credited to your annuity.

Example: Your participation rate is 80%, so you receive an 8% return on 10% earnings.

Rate Spread

Subtracts a set percentage from the index’s return before interest is credited.

Example: Your return is 7% once your 4% spread is deducted from your index’s 11% gain.

Some annuities use more than one limiting feature, which can further restrict upside.

Example: Your annuity contract contains a participation rate of 75% and a cap of 5%. The index’s growth rate is 10%, resulting in a participation-rate return of 7.5%. However, this is subject to the cap, so your maximum credited interest is 5%.

The Bottom Line

Participation rates help make fixed index annuities possible. They allow providers to supply downside protection while still offering the opportunity for growth.

The key is understanding what you’re trading:

- Less upside than market-based annuities

- More protection than traditional investments

When aligned with your retirement goals, participation rates can be a powerful part of a conservative growth strategy.