Since 2021, I have been an advocate of investing in U.S. Treasury Series I savings bonds, which are commonly referred to as I bonds. These stable-value debt instruments are backed by the full faith and credit of the U.S. government and indexed to the Consumer Price Index (CPI). As a result, they exhibit zero price volatility, have no credit risk and are protected from inflation.

I bonds are virtually risk-free; however, they are exposed to one meaningful risk — liquidity risk. I bonds cannot be redeemed until one year after purchase.

Recent I Bond Performance

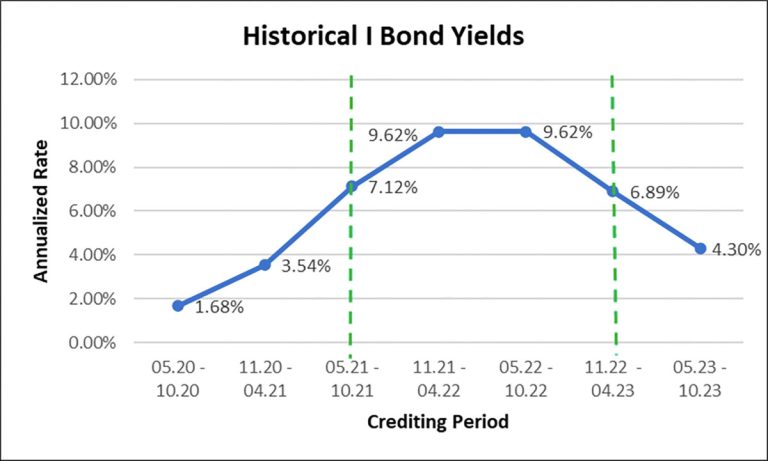

As illustrated below, the annualized interest rate on I bonds fluctuated between 6.89% and 9.62% between May 2021 and April 2023.

This was a prime time to invest in I bonds. During this two-year period, no other investment in the world offered a comparable risk-adjusted return. However, the landscape just changed.

In an effort to moderate inflation, the U.S. Treasury Department reduced the annualized yield on I bonds to a mere 4.30% for the period of May 1, 2023, to Oct. 31, 2023. This applies to new issues and previously issued I bonds rolling into the period.

If you purchased an I bond or experienced a term rollover within the past six months, your interest rate will change from 6.89% to 4.30% according to the schedule I’ve outlined below.

| Month of Issue or Rollover | Rate Change Date |

| November 2022 | May 1, 2023 |

| December 2022 | June 1, 2023 |

| January 2023 | July 1, 2023 |

| February 2023 | Aug. 1, 2023 |

| March 2023 | Sept. 1, 2023 |

| April 2023 | Oct. 1, 2023 |

Advice for I Bonds Investors

As a result of the downward rate adjustment, investing in I bonds is no longer a “no-brainer.” Personally, I plan to cash out the $20,000 I invested in these vehicles over the past few years (the result of maxing out my $10,000 annual allowance in December 2021 and January 2022).

I am weighing the following two reinvestment options for the proceeds (or, potentially, a combination of the two):

- Funnel the money into a high-yield savings account and capture an annualized yield in the range of 4.50% to 5.00%. These accounts are FDIC-insured and are not exposed to liquidity lock-ups.

- Invest the money in a high-quality, floating-rate bank loan fund. Currently yielding about 9.00% annually, the fund is exposed to equity-like volatility, but I’m comfortable with its risk profile. The underlying loans are diversified across all sectors of the economy, backed by sound collateral and structured to reset their interest rates periodically. This mitigates credit and interest rate risk.

I Bonds Interest Penalty Consideration

While I am already formulating a reinvestment plan, now is not the right time to liquidate I bonds. I am going to wait until the rate on each $10,000 block moves from 6.89% to 4.30% — June 1, 2023, for the December purchase and July 1, 2023, for the January purchase — plus three additional months.

The rationale for waiting an additional three months is to soften the blow of the three-month interest penalty the Treasury Department levies on any redemption made within the first five years of purchase. Instead of forfeiting that three months of interest at 6.89%, I plan to do so at 4.30%.

Redeeming an I bond within the first five years of purchase entails forfeiting the last three months of interest earned.

My Closing Thoughts

All things considered, I do not recommend putting new money into I bonds or holding onto previous purchases (beyond the point at which you earn three months of interest at 4.30%). There are alternatives that offer stronger risk-adjusted returns and more flexibility.

Nevertheless, if the risk-free nature of I bonds appeals to you, TreasuryDirect.gov can offer a wealth of information on these instruments.