What Is an Interest Rate Spread?

An interest rate spread is a feature used in some fixed index annuities (FIAs) that subtracts a set percentage from index gains before interest is credited to your annuity. It is sometimes referred to as a margin, asset fee or administrative fee.

Instead of limiting gains with a cap or sharing gains through a participation rate, a spread reduces the index return itself. This trade-off helps insurers offer principal protection while still giving you a chance to earn interest linked to market performance.

How Interest Rate Spreads Work

An interest rate spread reduces your index gain before interest is credited to your annuity. Think of it as a hurdle your index return must clear before you earn interest.

- 1. The index does its thing

- Your FIA tracks an index (like the S&P 500) over a set period.

- 2. The insurer subtracts the spread

- The contract’s spread is deducted from the index gain for that period.

- 3. Your annuity gets credited interest (or 0%)

- If the remaining number is positive, you get credited interest. If it’s not, you typically earn 0% for that period (depending on the strategy).

Example of an Interest Rate Spread

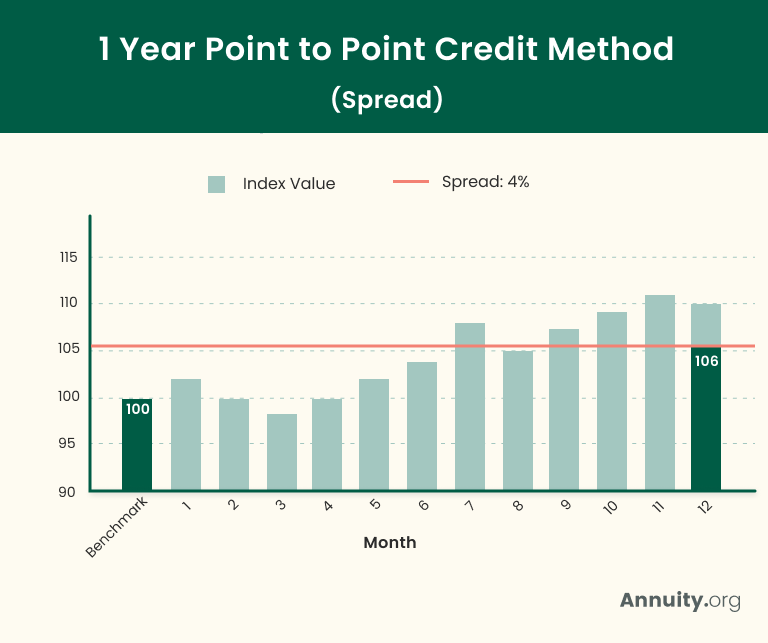

A spread is a percentage the insurer subtracts from the index gain before crediting interest to your FIA. Let’s consider an example.

The index starts at 100 and ends the year at 106, for a 6% gain. With a 4% spread, the annuity subtracts that amount from the gain:

6% gain − 4% spread = 2% credited interest

Only the start and end values matter; the index’s ups and downs during the year don’t impact the result.

Spreads can feel “invisible” in very strong years and significant in moderate years. In the latter, they can be the difference between earning something and earning 0%.

Rate Spreads vs. Other Crediting Methods

Spreads, caps and participation rates all limit credited interest — but they do it in very different ways, which can lead to different results in the same market.

Cap Rate

Sets a ceiling on how much interest your annuity can earn in a given period, even if the index performs higher.

Example: Your return is limited to your 8% cap despite an index gain of 15%.

Participation Rate

Determines the percentage of the index’s gain that’s credited to your annuity.

Example: Your 85% participation rate translates to 8.5% on a 10% gain (85% of 10%).

Spread

Subtracts a set percentage from the index’s return before interest is credited.

Example: Your 4% spread is deducted from your 6% index gain for a 2% credited interest.

In some cases, multiple limitations may apply to a single annuity contract, such as a spread and participation rate. Example: Your annuity provider applies a 3% spread after calculating your 90% participation rate. For an index growth of 10%, your credited interest is 6% ((10% growth x 90% participation rate) – 3% spread = 6% return).

There’s no single limiting feature that’s right for everyone. Spreads, caps and participation rates all involve trade-offs between growth potential and predictability. Some may perform better in strong markets, while others may be more forgiving in moderate ones. The best choice often depends on market expectations, comfort with variability and how the annuity fits into your broader retirement strategy.

Get Guidance Before You Decide

Are Interest Rate Spreads Bad?

Rate spreads aren’t necessarily bad — they’re a trade-off that can make downside protection possible, but they reduce upside in positive markets.

When a spread can make sense

- You value principal protection and accept limited upside.

- You prefer a more conservative approach than stocks or variable annuities.

When a spread can feel frustrating

- The index is up modestly and the spread absorbs most (or all) of the gain.

- Another FIA credits more using a cap or participation rate in the same market.

“Annuity crediting amounts can vary from company to company and may change based on the underlying index chosen. One suggestion I consistently offered clients is to back-test or model how an annuity would have performed in multiple past market environments. This ensures a comprehensive understanding of what is possible with a given product.