What Is a Cost of Living Rider?

A cost of living rider (often called a COLA rider) is an optional feature you can add to your annuity to help your income keep up with inflation. When you include this rider, your annuity payments automatically increase each year, typically by a set percentage or in line with the Consumer Price Index (CPI).

This adjustment helps preserve your purchasing power over time, especially during long retirements when rising prices can quietly erode the value of your income. However, there’s a trade-off: adding a cost of living rider will lower your initial payment amount, since the insurance company accounts for those future increases in your contract.

What are the Benefits of a COLA Rider?

Inflation is one of the biggest threats to retirement income. Even mild inflation of 2% to 3% per year can significantly reduce your purchasing power over 20 to 30 years. That means your retirement savings — and the fixed income you rely on — will buy less and less as you age.

A cost of living rider helps offset this risk by ensuring your payments rise over time. Without it, your annuity payments remain level, which means they’ll lose real-world value if prices keep rising. For retirees on fixed budgets, that loss can make a big difference in covering essentials like groceries, housing, or medical costs.

Inflation is perhaps the number one enemy of retirees. Even a small level of inflation can erode purchasing power in a relatively short period.

— Brandon Renfro, Ph.D., CFP®, RICP®, EA

Many people find the idea of predictable, growing income reassuring. A COLA rider helps you maintain the lifestyle you planned for, rather than watching your standard of living shrink over time.

How Does a Cost of Living Rider Work?

When you add a COLA rider to your annuity, your income payments automatically increase each year based on one of two methods:

Fixed Percentage Increase for a Cost of Living Rider

Your payment increases by a set percentage each year, typically ranging from 1% to 6%. This increase may be applied on a simple or compound basis.

- Simple Increase

- A simple increase means the same dollar amount is added each year (for example, 3% of your starting payment).

- Compound Increase

- A compound increase means each new payment builds on the previous year’s amount, offering slightly higher growth over time.

- Predictability

- Provides predictable, steady income growth that doesn’t depend on inflation rates; ideal for moderate or stable inflation periods.

CPI-Based Increase for a Cost of Living Rider

Your payment increases each year based on changes in the Consumer Price Index (CPI), which measures inflation in the economy.

- Inflation Tracking

- Adjusts payments in line with actual inflation, helping your income maintain real purchasing power.

- Variable Growth

- In years when inflation is low, your increase will be smaller, and in rare cases of deflation, your payment could stay level or decrease.

- Flexibility

- Offers flexible protection that closely tracks real-world costs but can make payments less predictable from year to year.

These adjustments are built into the annuity contract and occur automatically, providing peace of mind that your income will evolve with the economy.

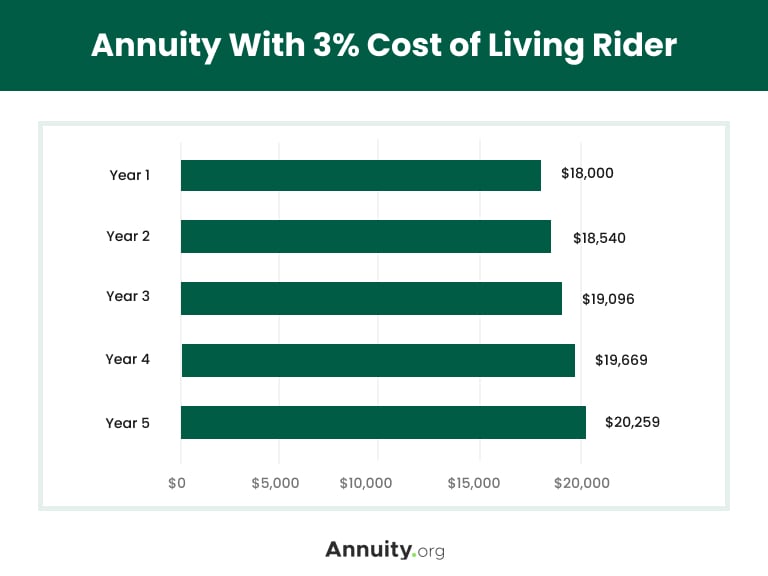

If your starting payment is $2,000 per month and your rider includes a 3% annual increase, your income would rise to $2,060 the following year, then $2,121 the next, and continue compounding over time.

The tradeoff for opting for a COLA rider is that your initial benefit amount will be reduced. However, depending on your unique circumstances, this could pay off in the long run as your payment increases over the duration of the payout period, helping you to maintain your spending power and combat inflation.

Over time, the real value of your annuity payments may fall and leave you with less purchasing power due to inflation. A cost of living rider offers you protection, but it does come with a cost.

What are the Pros and Cons of Cost of Living Riders?

There are several factors to consider when deciding whether to add a cost of living rider to your annuity. Key considerations include inflation, the cost of the rider and your other retirement assets.

Pros & Cons of Cost of Living Riders

Pros

- Protection against inflation

- Creates predictable annual income growth

- Provides peace of mind during long retirements

- Helps preserve long-term purchasing power

Cons

- Reduces your initial payment amount

- May take years for payments to “catch up” to level payments

- Adds complexity to the contract

- In CPI-based riders, growth depends on inflation trends

A COLA rider helps retirees who fear losing financial control over time. Knowing your income will increase every year can ease anxiety and help you plan for the future more confidently. Still, it’s important to remember that your overall benefit is delayed, and it can take several years for the higher payments to offset the reduced starting amount.

See How Much You Could Earn With Today’s Best Rates

What Are Some Alternatives to a Cost of Living Rider?

If a cost of living rider doesn’t fit your situation, there are other ways to protect your income from inflation:

- Delay Social Security: Each year you delay claiming benefits until age 70 increases your payout, and your Social Security income already includes a built-in COLA.

- Invest for Growth: Keeping a portion of your portfolio in assets that historically outpace inflation, such as equities or inflation-protected bonds, can provide balance.

- Adjust Spending Over Time: Spending less early in retirement gives your savings room to grow and provides flexibility if inflation rises later.