A recent Annuity.org survey reveals the top priorities — and anxieties — driving financial decisions for Americans approaching or living in retirement.

One sentiment stood out among the many responses:

“I don’t want to outlive my money — or get talked into something I don’t understand.”

– Annuity.org Survey Respondent

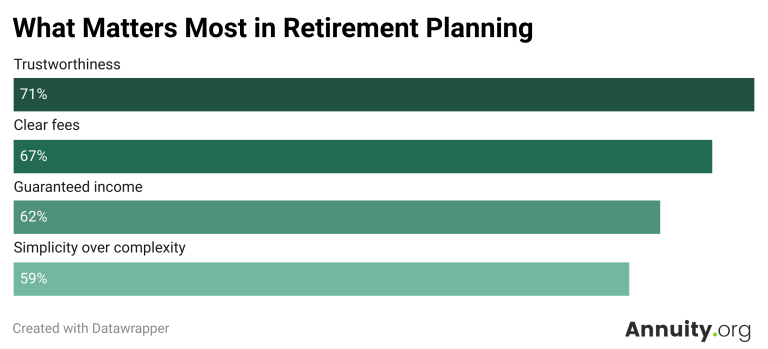

To uncover what truly matters when choosing a financial provider, we surveyed more than 500 adults aged 50 and older. The results show a clear shift in focus: retirees and near-retirees value trust, transparency, and simplicity just as much, if not more, than investment returns.

In this report, we break down the factors that drive confidence, the role of digital access, the weight of trust versus rates, and who’s making these critical decisions. The findings offer actionable insights for financial providers looking to better serve this growing demographic.

The Top Priorities in Retirement Planning

Retirement planning decisions aren’t always driven by flashy rates or speculative growth. What people want is confidence that their money — and their future — is in safe, trustworthy hands.

The data above reveals that today’s retirees are focused on protection and clarity, not aggressive growth. It reflects a deeper emotional need to feel safe, informed and in control of their financial future. Rather than navigating complexity or worrying about market losses, consumers want straightforward solutions and honest guidance they can count on for the long haul.

Who’s Making These Decisions?

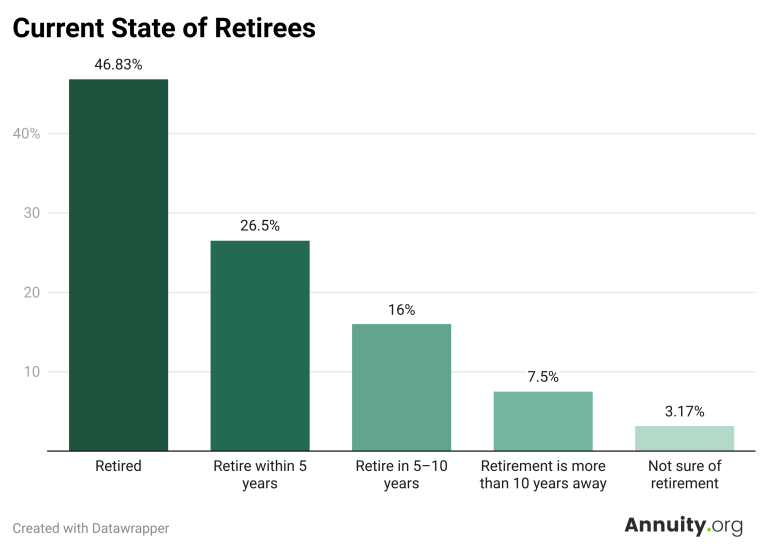

This survey wasn’t limited to a pre-retirement audience — it captured insights from individuals actively living in retirement, too. Nearly half (46.83%) of respondents are already retired, and another 26.5% expect to retire within the next five years. That means more than seven in 10 participants are either making financial decisions in retirement right now or preparing for an imminent transition.

The remaining respondents include 16% who plan to retire in the next 5–10 years, 7.5% whose retirement is more than a decade away, and 3.17% who are unsure about their retirement timeline.

This demographic makeup is critical because it underscores that these survey responses reflect real-world, near-term decision-making, not abstract hypotheticals. For the majority of participants, choices about financial providers aren’t theoretical — they’re directly tied to current income needs, long-term stability, and peace of mind.

For financial providers, this means the stakes are high. Today’s retirees and soon-to-be retirees expect clarity, transparency, and trust from the professionals they work with. Products and rates matter, but they must be delivered in a way that supports security and confidence throughout the retirement journey.

Longevity Builds Trust

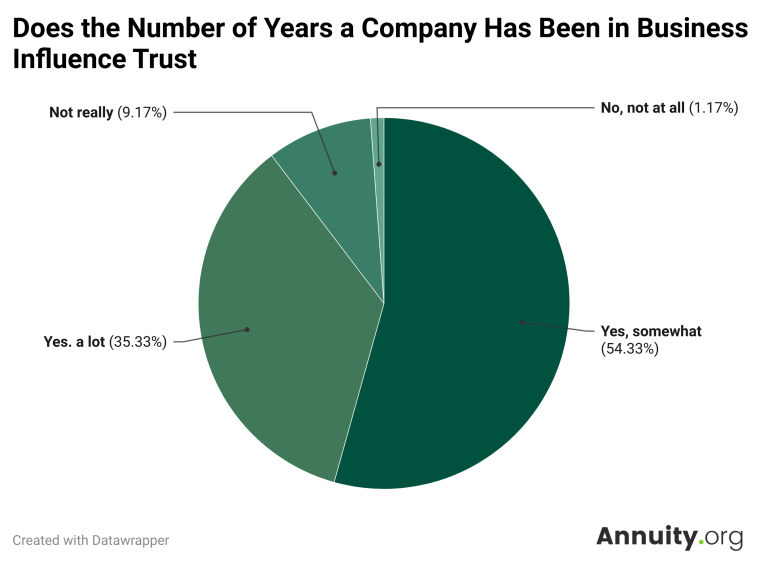

A company’s history in business plays a significant role in shaping consumer trust. Over half of respondents (54.33%) said the number of years a company has been in operation influences their trust somewhat, while 35.33% said it matters a lot.

Only a small portion were indifferent, with 9.17% saying it doesn’t really impact their trust and 1.17% saying it doesn’t matter at all.

These results reinforce the idea that experience and proven stability matter, especially in the financial sector. A long-standing presence often signals reliability, resilience through market cycles, and the ability to meet long-term commitments — all qualities that retirees and pre-retirees value when selecting a provider.

Financial Strength Ratings Hold Significant Weight

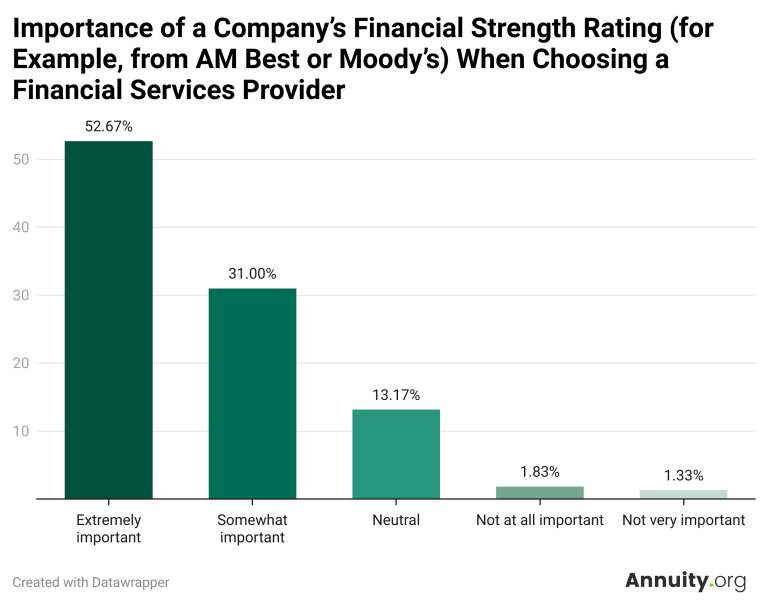

When evaluating financial service providers, financial strength ratings, such as those from AM Best or Moody’s, are a decisive factor for most consumers. Over half of respondents (52.67%) said such ratings are extremely important in their decision-making process, and another 31% rated them as somewhat important.

Only a small percentage expressed neutrality (13.17%) or said ratings were not very important (1.33%) or not important at all (1.83%).

These findings reinforce a theme seen throughout this survey: trust and security are top priorities, particularly among retirees and pre-retirees who depend on stable, long-term financial relationships. A high financial strength rating signals that a provider is well-positioned to meet its obligations, even in challenging market conditions — a quality that offers peace of mind when planning for retirement income and wealth preservation.

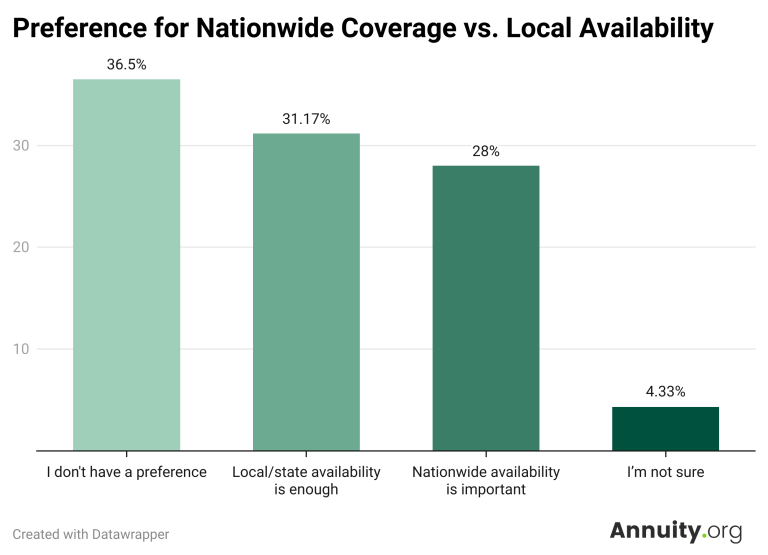

Local vs. Nationwide Availability

When it comes to a company’s geographic reach, preferences among respondents were split. The largest group, 36.5%, said they have no preference between working with a nationwide company or one with limited regional reach.

However, 31.17% indicated that local or state-level availability is enough for their needs, suggesting that proximity and familiarity may be more valuable than broad reach for some consumers.

In contrast, 28% said nationwide availability is important, signaling that a sizable portion of retirees and pre-retirees see value in working with providers that operate in all 50 states — possibly for greater consistency, resources, and service flexibility.

Only 4.33% were unsure, highlighting that most people have a clear stance on this factor. For financial providers, the takeaway is that bigger isn’t always better, but having the ability to serve clients seamlessly across regions can be a differentiator for those who prioritize accessibility and reach.

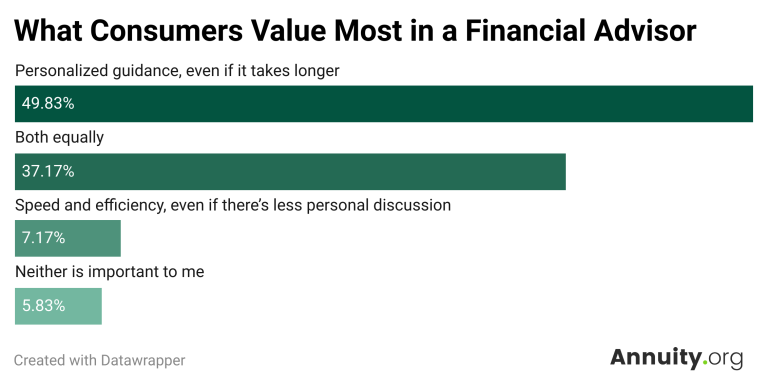

Personalized Guidance Takes Priority

When working with a financial advisor, personalized guidance clearly outweighs the desire for speed alone. Nearly half of respondents (49.83%) said they value tailored advice — even if it takes longer — over quick, less personalized interactions.

Another 37.17% said they value both equally, indicating that efficiency and personal attention are not mutually exclusive for many retirees. In contrast, only 7.17% prioritized speed and efficiency over personalized discussions, and 5.83% said neither was important to them.

These findings suggest that for most retirees and pre-retirees, financial decisions are too important to rush. They want advisors who take the time to understand their unique situations, explain options clearly, and help them make confident, informed choices — even if that means a longer process.

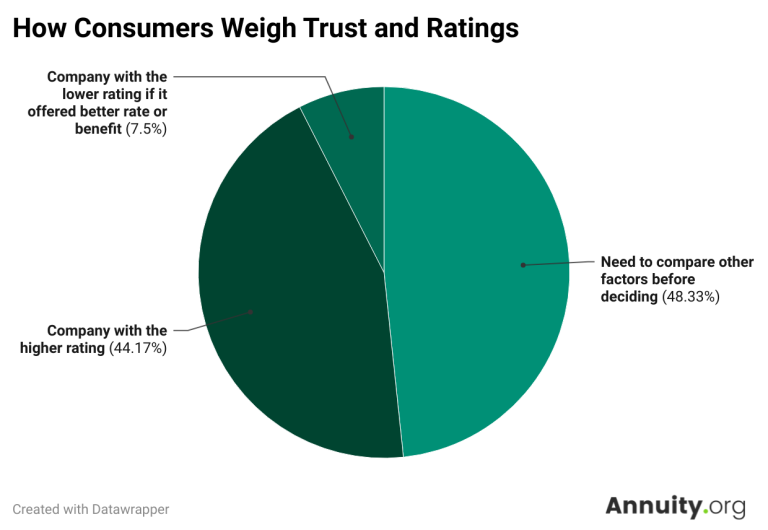

Trust Outweighs Rates

When faced with a choice between two providers offering the same product — one with a higher financial strength rating and the other with a better product rate or benefit — most respondents prioritized trust and long-term stability over short-term gains.

According to the survey, 44.17% said they would choose the provider with the higher financial rating, even if it meant accepting a lower product rate. Only 7.5% were willing to go with the lower-rated company for the sake of a better offer. But nearly half (48.33%) said they would need to evaluate additional factors before making a decision, showing that trust is a key driver but not the only consideration in complex financial choices.

For retirees and those nearing retirement, security outweighs speculation. This is especially true when the stakes involve lifetime income and the preservation of financial stability. A strong financial strength rating signals reliability, reduces uncertainty, and gives consumers confidence that their provider will be there to honor commitments for decades to come.

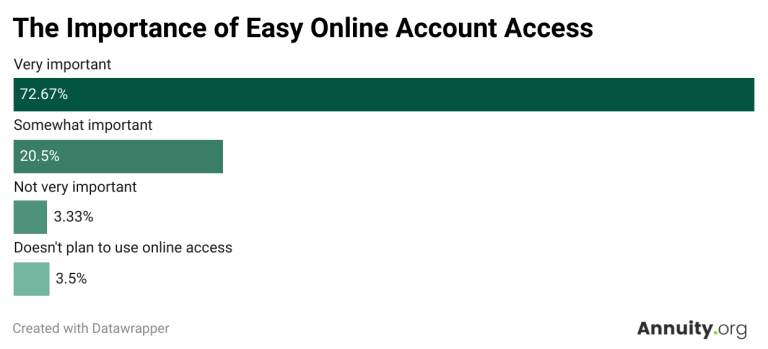

Simplicity and Access Matter

The survey revealed that digital convenience is now a universal expectation, not a generational divide. Nearly 73% of adults aged 50 and older said that having easy online access to their accounts and policies is “very important,” with an additional 20.5% considering it “somewhat important.” This means more than nine in ten respondents place at least some value on digital accessibility.

Only a small minority (3.33%) said online access was “not very important,” and an equally small percentage (3.5%) indicated they do not plan to use online account tools at all. These numbers show that even among older adults, the expectation for self-service, on-demand access is nearly universal.

For retirees, digital account access isn’t simply a convenience; it’s about control, confidence, and independence. Being able to log in at any time to review balances, monitor policy details or update personal information allows them to feel more secure in their financial decision-making.

When combined with user-friendly advice, responsive customer support, and timely service, the picture is clear: retirees value providers who make financial management smooth, transparent, and free from red tape or guesswork.

Customization Is Key

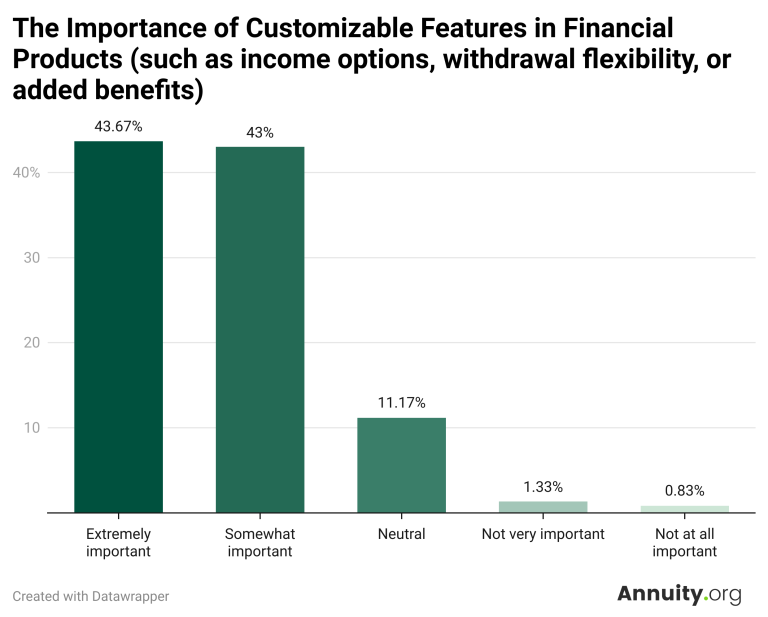

When evaluating financial products, nearly nine in 10 respondents said customizable features, such as income options, withdrawal flexibility, or added benefits, are important. 43.67% rated them as extremely important, while another 43% said they were somewhat important.

Only a small fraction of participants were indifferent (11.17% neutral) or felt these features were not very important (1.33%) or not important at all (0.83%).

These results highlight that one-size-fits-all solutions aren’t enough. The ability to tailor financial products to fit individual needs, preferences, and life circumstances is a major factor in building trust and satisfaction. Customization not only allows clients to align products with their financial goals but also provides a sense of control and flexibility, which are qualities highly valued in retirement planning.

What Drives Confidence in a Financial Provider

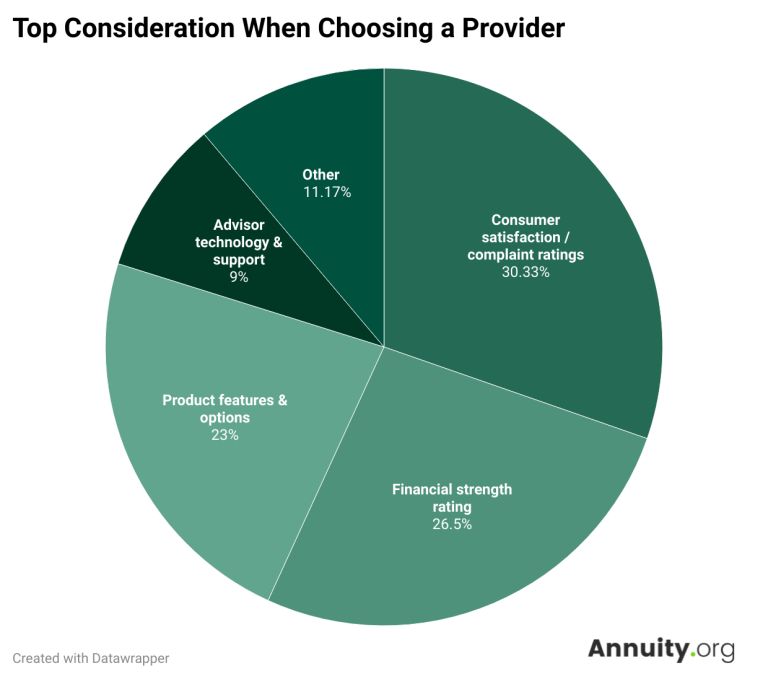

When respondents were asked to identify the single most important factor in choosing a financial services provider, one element stood out: consumer satisfaction and complaint ratings. Nearly a third of participants (30.33%) said a provider’s reputation, reflected in positive client experiences and minimal complaints, was their top consideration.

Financial strength ratings ranked close behind at 26.5%, underscoring the importance of long-term stability and reliability in handling retirees’ assets. For many, a strong financial foundation was viewed as essential to protecting their retirement income against market volatility or economic downturns.

Product features and options accounted for 23% of responses, showing that while choice and flexibility matter, they are still secondary to trust and proven performance. Advisor technology and support (9%) and other factors (11.17%) rounded out the results, highlighting that personal service tools and unique individual needs still play a role, albeit a smaller one.

These findings make it clear: retirees and near-retirees want more than competitive rates or flashy product features. They seek providers who can demonstrate integrity, offer dependable service, and maintain a consistent track record of meeting client needs. Trust, service quality, and proven performance remain the true cornerstones of confidence.

Top Trust Drivers According to Respondents

| Category | Key Insights | What Respondents Said |

|---|---|---|

| Reputation & Longevity | Long-standing, well-known companies are seen as more trustworthy than new entrants. Stability and a proven track record are key. | “I generally trust the big banks that have been in business for a long time.” |

| Customer Reviews & Word of Mouth | Consumer reviews, especially personal recommendations from friends and family, are a major driver of trust. | “If my financial advisor recommends them or if friends use them.” |

| Transparency & Honesty | Respondents want providers to “do what’s right,” be upfront about performance and fees, and avoid high-pressure sales tactics. | “I want transparency and down-to-earth people.” |

| Financial Ratings & Track Record | AM Best–type ratings, strong past performance, and a clean compliance history are critical for credibility. Security often outweighs better rates. | “I trust companies with good financial ratings and strong past performance.” |

| Personalized Service & Guidance | Nearly half of respondents value personalized guidance over speed, and many appreciate advisors who take the time to understand their needs. | “I have to meet someone and feel that the company is trustworthy.” |

| Customization & Flexibility | Almost 90% say customizable product features (income options, withdrawal flexibility, added benefits) are important or extremely important. | “Flexibility is key to making me feel in control.” |

Survey Insights That Shape Our Standards

We conducted this survey to better understand what matters most to people planning for or living in retirement, and to ensure those priorities guide our evaluation of financial service providers.

The feedback we received directly informed the methodology behind our Best Annuity Companies of 2025, reinforcing the importance of real-world trust factors like financial strength, transparency, customer satisfaction and a proven track record.

Retirement decisions are deeply personal, and often permanent. That’s why our evaluations focus not just on rates and features, but on the qualities that help retirees feel secure, respected and supported. These survey results confirm what we hear every day: when it comes to choosing a financial partner, credibility and care matter most.