retire under the Federal Employees Retirement System (FERS) before age 62, you may qualify for the FERS Annuity Supplement, also called the Special Retirement Supplement (SRS). This benefit provides extra monthly income meant to replace the Social Security you’re not old enough to receive yet.

In other words, if you meet FERS early-retirement requirements, you’ll receive your regular FERS pension plus this supplement until you turn 62. After that, the supplement stops and Social Security becomes your next source of income.

Eligibility rules and earnings limits can affect how much you receive, so understanding how the supplement works is important when planning your retirement.

How the Supplement Is Calculated — and What You Might Get

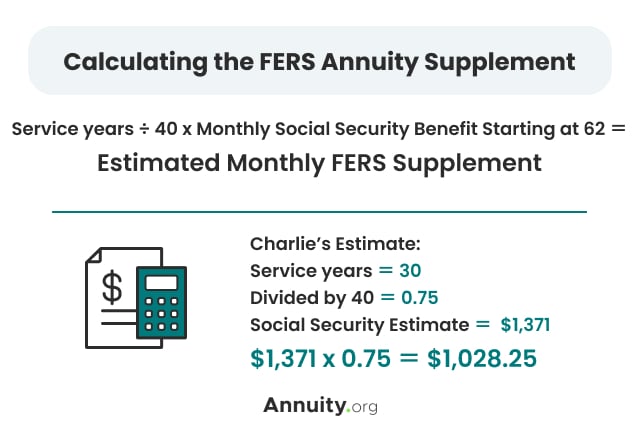

The supplement is intended to approximate the Social Security benefit you earned during your federal employment. The amount is determined using a formula that takes your years of FERS-covered civilian service and estimates what your Social Security benefit would have been at age 62.

Example: If a retiree has 30 years of FERS service and their projected Social Security at 62 is $1,500/month, the supplement might be roughly: (30 ÷ 40) × $1,500 = $1,125/month

This estimate gives an idea of what their supplement could be until they reach Social Security age.

Because the supplement mimics Social Security, it’s reduced if your retirement earnings exceed a certain threshold. For example, extra earned income (from a part-time job or self-employment) could reduce or even cancel the supplement.

How the FERS Supplement Works (At a Glance)

- The supplement fills the income gap between early retirement and Social Security.

- To receive it, retire under FERS before age 62 with an immediate, unreduced annuity.

- Amount is based on your years of service and estimated Social Security benefit at 62.

- It ends when you turn 62 or begin Social Security — and extra income in retirement can reduce it.

When the Supplement Ends

The supplement doesn’t last forever. In nearly all cases, it ends at the end of the month before you turn 62 or just before you start receiving Social Security benefits.

Because of that, if you retire early, it’s best to plan ahead: know how much your basic FERS pension will be on its own, and make sure you have enough saved or invested to cover living expenses once the supplement stops.

Potential Pitfalls — What Could Reduce or Eliminate Your Supplement

Your FERS supplement can disappear more easily than many retirees realize. If you retire under a deferred or postponed benefit instead of an immediate, unreduced pension, you generally won’t qualify for the supplement at all. Even if you do qualify, the payment may shrink if you earn too much income after retiring. Wages and self-employment earnings count toward an annual limit, and anything you earn above that limit reduces the supplement — in some cases wiping it out completely.

The supplement also ends automatically once you turn 62 or become eligible for Social Security, even if you decide not to claim Social Security right away.

Example: A 58-year-old retiree takes an immediate FERS pension and qualifies for the supplement. She later picks up consulting work that pushes her income above the earnings limit. Her supplement is reduced month by month until, eventually, it drops to zero.

Who Especially Benefits from the FERS Supplement

The supplement is most valuable for employees who retire early with many years of federal service and rely heavily on their FERS pension for income. It’s especially helpful for special-category employees — such as law enforcement officers, firefighters and air-traffic controllers — who often retire in their 50s and can begin receiving the supplement right away.

It also benefits anyone who wants to bridge the gap between their FERS retirement date and the start of Social Security, helping them maintain steady income without drawing down savings.

Example: A 57-year-old law enforcement officer retires with 25+ years of service. The supplement provides Social-Security-like income immediately, covering the years until he reaches 62 and becomes eligible for actual Social Security.

Get Guidance Before You Decide

How To Use the FERS Supplement in Your Retirement Plan

The FERS Annuity Supplement can be an important part of a federal retiree’s income strategy, but only if you understand when it applies, how it’s calculated, and when it ends.

If you’re eligible for an immediate, unreduced FERS pension and retire before 62, the supplement gives you a built-in bridge to Social Security. The amount you receive depends largely on your years of service and your estimated Social Security benefit.

Before you retire, estimate your monthly income with and without the supplement, and consider how extra earnings or age changes might affect that. Planning ahead can help ensure a smoother transition and avoid income gaps.

I have many clients who work within the federal government and have retirement plans such as the Federal Employees Retirement System (FERS) through their employer. Many federal employees opt for early retirement, utilizing annuity benefits to supplement their income in retirement, in addition to Social Security.