Annuities are tax-advantaged financial products designed to help you save for retirement or create guaranteed income. Their primary tax benefit is tax-deferred growth, meaning you don’t pay taxes on earnings while the money stays inside the contract. However, that doesn’t mean annuities are tax-free.

How much tax you owe, and when you owe it, depends mainly on how the annuity is funded, when and how you take money out, and whether the annuity is qualified or non-qualified.

The Core Tax Rule: Annuities are not taxed while they grow; they are taxed when you take money out.

This rule applies to nearly all annuities. As long as your funds remain in the contract, you typically won’t owe annual taxes on interest or earnings. Taxes are triggered only when you begin taking withdrawals or income payments, and the way those payments are taxed depends on the structure of your annuity and how it was funded.

What “Tax-Deferred” Means for Annuities

Tax-deferred growth means the money inside your annuity can earn interest or investment returns without triggering yearly tax bills. This feature can be especially valuable for long-term savers who don’t need immediate access to their money.

Why This Matters

Because taxes aren’t taken out each year, your earnings stay invested and continue to compound. Over time, that can result in higher total growth compared to a taxable account where taxes reduce returns annually.

Tax deferral can also help with retirement planning. Many people expect to be in a lower tax bracket once they stop working, which may reduce the overall tax impact when withdrawals begin.

What Tax-Deferred Does Not Mean

Tax deferral does not eliminate taxes altogether. You will eventually owe taxes on earnings when money comes out of the annuity. In addition, annuity withdrawals are generally taxed as ordinary income, not at lower capital gains rates.

Have a Tax Question About Annuities?

Get quick, trustworthy answers based on Annuity.org’s expert-reviewed content.

Qualified vs. Non-Qualified Annuities

One of the most important distinctions in annuity taxation is whether the annuity is qualified or non-qualified. This determines how much of each withdrawal is taxable.

Qualified Annuity

A qualified annuity is purchased with pre-tax dollars, typically inside a tax-advantaged retirement plan. Because the money went in before taxes were paid, the IRS treats all withdrawals as taxable income.

Common examples include annuities held within:

- Traditional IRAs

- 401(k) plans

- 403(b) plans

Since no taxes were paid upfront, 100% of each withdrawal is taxed as ordinary income.

Non-Qualified Annuity

A non-qualified annuity is purchased with after-tax dollars outside of a retirement account. Because you already paid taxes on your original contribution, the IRS does not tax that portion again.

In this case:

- Your original investment (principal) is not taxed again

- Only the earnings portion of withdrawals is taxable

This structure allows for more tax-efficient income when withdrawals are spread out over time.

Quick Comparison

| Feature | Qualified Annuity | Non-Qualified Annuity |

|---|---|---|

| How it’s funded | Pre-tax dollars | After-tax dollars |

| Tax during growth | Tax-deferred | Tax-deferred |

| Tax on withdrawals | Entire amount taxable | Earnings only |

| IRS penalty before 59 ½ | Yes | Yes |

How Annuity Withdrawals Are Taxed

The way you access your money has a direct impact on how much tax you owe.

Lump-Sum Withdrawals

Taking a lump sum withdrawal can trigger a significant tax bill.

- Qualified annuities: The entire withdrawal is taxable as ordinary income.

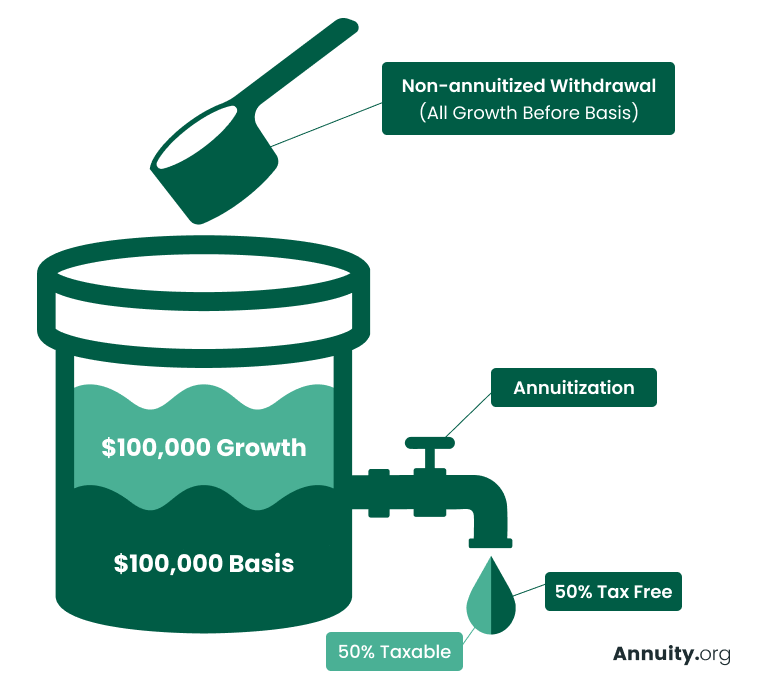

- Non-qualified annuities: Earnings are taxed first, before principal is returned.

This “earnings-first” rule is known as LIFO (Last In, First Out) and often catches people off guard. Large lump sum withdrawals early in retirement may push you into a higher tax bracket than expected.

Regular Income Payments (Annuitization)

If you convert your annuity into a stream of income payments, taxes are spread out over time using an IRS formula, rather than being applied all at once. This approach can make income more predictable and easier to manage from a tax standpoint.

Tax planning is an important endeavor, especially for individuals embarking on retirement with a lean fixed income. For example, a colleague of mine was worried his tax bill would not leave him enough money to live comfortably. Fortunately, after examining his annuity, it was evident the contract had been funded on a non-qualified basis, meaning only the earnings component of the distributions would be taxed.

The Exclusion Ratio

The exclusion ratio determines how much of each annuity payment is taxable once income payments begin. Instead of taxing the entire payment, the IRS allows part of each check to be treated as a return of your original investment, which is not taxed, while the remaining portion represents earnings and is taxed as ordinary income.

This tax treatment continues until you’ve recovered your full original investment (your cost basis). After that point, all remaining annuity payments are considered earnings and become fully taxable. For many retirees, this structure can make steady annuity income more tax-efficient than taking large withdrawals, particularly when planning for long-term, predictable expenses.

Example: Suppose you invest $100,000 in an annuity and, over time, it grows to $200,000. Half of that total represents your original investment (basis), and half represents earnings. When you annuitize, the exclusion ratio treats 50% of each payment as a tax-free return of principal, while the remaining 50% is taxed as ordinary income. Once you’ve received the full $100,000 you originally invested, all future payments become fully taxable.

Early Withdrawal Rules and Penalties

Withdrawing money from an annuity before the IRS considers you “retirement age” can significantly increase your tax bill. In addition to regular income taxes, early withdrawals often trigger penalties designed to discourage short-term use of long-term retirement products.

Understanding these rules ahead of time can help you avoid costly surprises and plan for emergencies more carefully.

Before Age 59 ½

If you take money out of an annuity before age 59½, the IRS generally treats it as an early withdrawal. That means:

- Earnings are taxed as ordinary income, meaning they are added to your taxable income for the year

- A 10% IRS penalty usually applies on top of any income taxes owed

This penalty applies to both qualified and non-qualified annuities, though it only affects the earnings portion of a non-qualified annuity withdrawal.

Common Exceptions

In some situations, the IRS allows early withdrawals without the additional 10% penalty. These exceptions are limited and must meet specific requirements.

Common examples include:

- Death of the annuity owner, when benefits are paid to beneficiaries

- Certain disability cases, as defined by IRS guidelines

- Structured lifetime income payments, such as annuitized payments that meet IRS distribution rules

It’s important to note that avoiding the penalty does not always mean avoiding taxes — earnings may still be taxable as ordinary income.

Exceptions depend on IRS rules and individual contract terms, so it’s important to review your specific annuity and, if needed, speak with a tax professional before making an early withdrawal decision.

Get Guidance Before You Decide

How Annuity Death Benefits Are Taxed

When an annuity owner dies, beneficiaries may owe taxes on the inherited annuity.

General Rules

- The original principal is not taxed again

- Earnings are taxed as ordinary income

- Beneficiaries typically must withdraw funds within a set time period

Unlike many other investments, inherited annuities do not receive a step-up in basis, which means taxes on earnings generally cannot be avoided.

Pros and Cons of Annuity Tax Treatment

Tax Advantages

- Tax-deferred growth

- No annual contribution limits for non-qualified annuities

- Predictable taxation for structured income payments

Tax Trade-offs

- Earnings taxed as ordinary income

- Early withdrawal penalties may apply

- Less favorable treatment than capital gains for some investors

Real-World Tax Scenarios

Scenario 1: Retiree Taking Monthly Income

A retiree uses a non-qualified annuity to generate monthly income. Each payment is partially taxable, allowing taxes to be spread out over time and avoiding a large one-time tax hit.

Scenario 2: Pre-Retiree Withdraws Early

A 55-year-old withdraws money for an emergency. Earnings are taxed as income and subject to a 10% penalty, significantly reducing the net amount received.

Scenario 3: IRA Annuity Distribution

An annuity held inside a traditional IRA follows standard retirement account rules. Every dollar withdrawn is taxable, regardless of how the annuity performed.

How Annuity Taxation Compares to Other Investments

| Investment Type | Tax During Growth | Tax on Withdrawal |

|---|---|---|

| Annuity | Tax-deferred | Ordinary income |

| Stocks (taxable account) | Taxed annually | Capital gains |

| Roth IRA | Tax-free | Tax-free |

| Traditional IRA | Tax-deferred | Ordinary income |

Are Annuities Tax-Efficient?

Annuities are neither “good” nor “bad” for taxes, they are specific. Their tax treatment is most effective when aligned with the right goals and time horizon.

They Tend To Work Well For:

- Long-term savers who want tax deferral

- People planning predictable retirement income

- Investors who value protection and guarantees

They Are Less Ideal For:

- Short-term investing

- Frequent withdrawals

- Those seeking capital gains tax treatment

Annuity taxes are manageable when you understand the rules — and costly when you don’t. Taking the time to understand how annuities are taxed can help you keep more of your retirement income working for you.