Certificates of deposit (CDs) are a type of savings account available through banks and credit unions.

You invest a fixed amount of money into a CD over a fixed period of time — typically six months, one year or five years. The issuing bank or credit union is required to periodically credit interest to your account during this time frame.

If you buy your CD through a federally insured bank, the FDIC will insure it for up to $250,000. But the $250,000 insurance covers all accounts in your name at the same bank. It does not cover each CD you have at the bank for that amount.

What to Know About Certificates of Deposit (CDs)

Like all investments, you should be aware of both the risks and benefits of CDs. The biggest risk with CDs is that inflation will increase faster than the interest on your investment.

The chief benefit is that CDs feature some of the highest returns of bank savings options and can be federally insured.

Read More: Investing for Beginners

Check the Fine Print When Buying a CD

When buying a CD, you should receive a disclosure statement from the issuing bank. This statement should tell you whether the interest rate you will receive is fixed or variable. Fixed means it will stay at the same rate for the term of the CD; variable means it can fluctuate.

What Are the Different Types of CDs Available?

There are several types of CDs, but they all essentially work the same way: You invest money for a period of time and receive interest. But the difference is how the terms, deposits, interest rates and other features work.

Understanding the differences between various types of CDs can help you choose the right CD option for you — not to mention it can add volumes to your financial literacy.

- Add-On

- Add-on CDs work more like a savings account, letting you deposit more money into the CD over its term. Most other CDs require that you make an initial deposit upfront, and don’t let you add any more money. The number of additional deposits to an add-on CD may be limited and can vary depending on the issuing bank. These CDs are best for someone who wants to use their CD like a savings account.

- Brokered

- While most CDs are purchased from banks, you can buy them from brokerage firms or independent sellers. These deposit brokers may offer higher interest rates for brokered CDs. These CDs are best for someone who doesn’t want to shop around for the best rates and wants to trade their CD on the secondary market.

- Bump-Up

- A bump-up CD lets you tell the issuing bank to “bump up” the interest rate on the CD for the remainder of its term if the bank raises the interest payment rate after you buy a CD. These CDs are best for someone who wants a longer-term CD but still wants to take advantage of the bank offering higher rates during the term.

- Callable

- A callable CD gives you a chance to earn higher interest, but you also have a risk. Callable CDs tend to offer higher yields when you first buy them. But if interest rates fall, the bank can call back your CD before it matures and reissue it with a lower interest rate. These CDs are best for someone willing to take on additional risk for the chance at an initial higher yield.

- Equity-Linked

- Equity-linked CDs are FDIC-insured CDs that tie their rate of return to a stock index, such as the S&P 500. Terms are typically five years but may vary. There is no guarantee that you will receive more than the guaranteed payment when it matures. These CDs are best for investors willing to put money aside typically for five years for a return based on the performance of a market index.

- Foreign Currency

- Foreign currency CDs are purchased with U.S. dollars but issued in foreign currencies — British pounds, euros or other currencies. Once they mature, they are converted back into dollars. They can be risky due to changing exchange rates (a strong dollar can wipe out any gains) and complicated even for people who understand currency markets. These CDs are best for experienced investors who understand foreign currency markets and are not risk averse.

- High-Yield

- A high-yield CD is typically a traditional CD that offers higher returns. High-yield CDs often require you to commit to a longer term or may require a larger deposit than traditional CDs. These CDs are best for investors looking for a higher-than-average yield but still want the safety and security of traditional CDs.

- IRA

- If you have an individual retirement account (IRA), you may want to include an IRA CD as part of your retirement plan. IRA CDs are offered by retirement planning companies and are better suited for people nearing retirement than for young investors. These CDs are best for people who are cautious about taking investment risks and want guaranteed returns from a CD to build up their retirement savings.

- Jumbo

- Jumbo CDs require a larger deposit than traditional CDs — $100,000 or more in most cases, but you may find some for lower amounts. They tend to pay only slightly higher returns than a traditional CD, but the higher deposit, over a typical five-year term, can result in a significantly higher payoff. These CDs are best for people able to make large investments — up to $100,000 or more — for years at a time.

- Liquid

- Also known as no-penalty CDs, liquid CDs let you withdraw your money from the CD before the term ends without having to pay a penalty. Both the rate and the yield are typically lower than those of a traditional CD. These CDs are best for someone who may need quick access to the money in their CD before it matures.

- Step-Up

- A step-up CD is similar to a bump-up CD, but with a step-up, you don’t have to tell the bank to raise the interest rate — the bank does it automatically at certain times during your CD. These CDs are best for someone willing to trade potentially higher initial rates to automatically take advantage of the bank increasing yield rates.

- Traditional

- With a traditional CD, you deposit a fixed amount of money for a specific period of time and are paid a fixed interest rate. You may face a penalty for early withdrawal, but you can cash out the CD at the end of its term, or roll it over for another term. These CDs are best for people who simply want to set aside money for a specific period of time with a guaranteed return.

- Zero-Coupon

- A zero-coupon CD is similar to a savings bond. You don’t receive annual or periodic interest on your CD. Instead, you buy a zero-coupon CD at a price below its face value. You keep it for several years at which time you cash it in for the full value. These CDs are best for investors willing to set aside a long-term investment and wait years for the CD to mature.

- Variable Rate

- A variable rate CD allows the interest rate to fluctuate based on the financial market. This can be good when rates are high, but risky when rates are low. Factors that affect the rate include the Consumer Price Index, market index levels, prime rate and treasury bill yields. These CDs are best for someone who prefers flexibility in earnings and isn’t worried about a decline in rate.

13 Types of CDs

What Is the Best Type of CD for You?

The best type of CD is whichever type fits your budget, your goals and how comfortable you are with different levels of risk.

There are several questions you should ask yourself and qualities to consider when comparing CD options.

- Minimum deposit

- How much are you willing to invest? Minimum deposits start at $500 for a traditional CD, but high-yield CDs can be in the six-figure range. You’ll need to consider how much you can afford.

- The CD term

- This is how long you will have to leave your money in the CD. You’ll need to consider how long you can leave your money in the CD and plan accordingly. Find the right length of time for you – a few months or several years.

- Early withdrawal penalty

- Are you going to need the money before your term is up? If you take the money out before the CD matures, you may have to pay early withdrawal penalties. Make sure you know what these will cost you before you buy.

- Interest rate

- Shop for the highest interest rates. This is your best hedge against inflation. The highest rates may be through brokers or online banks instead of through traditional banks. The higher the interest rate, the better the return on your investment.

- FDIC insurance

- Not all CDs are insured. Before buying a CD, make sure it’s FDIC-insured. If the seller suddenly collapses – though this is rare – you’ll get your money back. This federal insurance covers up to $250,000 – but if you and your spouse open a joint CD, it doubles.

What to Consider Before Buying a CD

Ranking these considerations in order of importance to you can let you compare the qualities of each different type of CDs to find the one that fits best for you.

Read More: What Is a Dividend?

What to Consider When Evaluating CD Rates

CD rates are just one thing to consider when comparing certificates of deposit. The risk-free nature of CDs and the length of the term play important roles in determining which CD may be right for you.

Keep in mind that online banks typically offer much higher CD rates than most traditional national banks.

If you want your money to be more liquid than a CD traditionally allows, you may want to compare the CD’s rates to online savings or money market accounts to see if that’s a better fit for you.

Certificates of deposit allow you to save money and — typically through early-withdrawal penalties — discourage you from tapping into those savings. They can be a commitment and can tie up your money when you may need it for another expense — or when a better investment opportunity comes along.

Does It Make Sense to Buy Several Different Types of CDs?

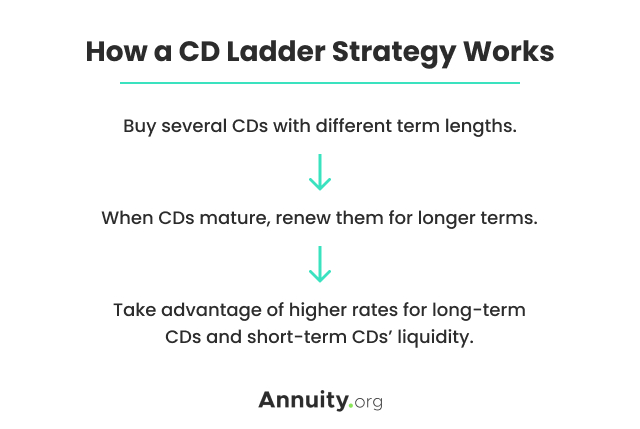

An investment strategy called CD laddering involves buying multiple CDs at the same time, but staggering when they mature.

A laddering strategy helps you get around problems with trying to time your purchases to the rise and fall of interest rates. It can reduce your risk of missing a bump in rates or of locking in a low interest rate.