Key Takeaways

- A retirement income fund ensures retirees receive a steady income stream by investing in a diversified portfolio like stocks and bonds.

- RIFs come in various forms, including mutual funds and ETFs. The underlying assets and risk profiles can vary from one fund to the next.

- The primary benefit of RIFs is their ability to offer retirees reliable income to cover living expenses and some nonessential purchases.

- RIFs drawbacks include exposure to price volatility, credit risk and limited growth potential.

What Is a Retirement Income Fund?

A retirement income fund (RIF) is a type of investment vehicle designed to provide a steady stream of income to individuals during their retirement years.

A RIF provides retirement income by investing in a portfolio of income-oriented assets, such as bonds, floating-rate bank loans, dividend-paying stocks and real estate. Then, it periodically distributes the earnings from these assets to its pool of investors.

Multifaceted investments like RIFs can be a key part of a retirement plan. However, RIFs are not designed to provide guaranteed income. Unlike annuities, RIFs can be highly sensitive to downturns in the market, which can lead to a loss of investment and erratic income streams.

Many retirees lack pensions and want to simulate the regular income payments they used to have throughout their working years. Social Security is a good foundation but they need more income that they can reliably count on. Retirement income funds (RIFs) are an option to consider to create a “retirement paycheck.” RIFs can provide a regular stream of income until invested assets are exhausted.

Types of Retirement Income Funds

There are three common types of retirement income funds:

- Mutual funds

- Exchange-traded funds (ETFs)

- Limited liability partnerships

Regardless of the structure, RIFs are meant to provide investors with a steady stream of income. However, the size and reliability of this income stream may vary depending on the assets in which the fund is invested in and their inherent risks.

RIFs are branded with a variety of descriptive terms, such as high-income, income-oriented, multi-asset and balanced. The underlying strategies can differ, but the overarching objective is the same — to generate consistent income as sustainably as possible.

To generate such consistent income, most RIFs consist of a diverse assortment of investment vehicles, including those outlined below.

- U.S. investment-grade bonds

- Large, dividend-paying stocks

- Yield-enhancing, satellite asset classes

- Cash and cash equivalents

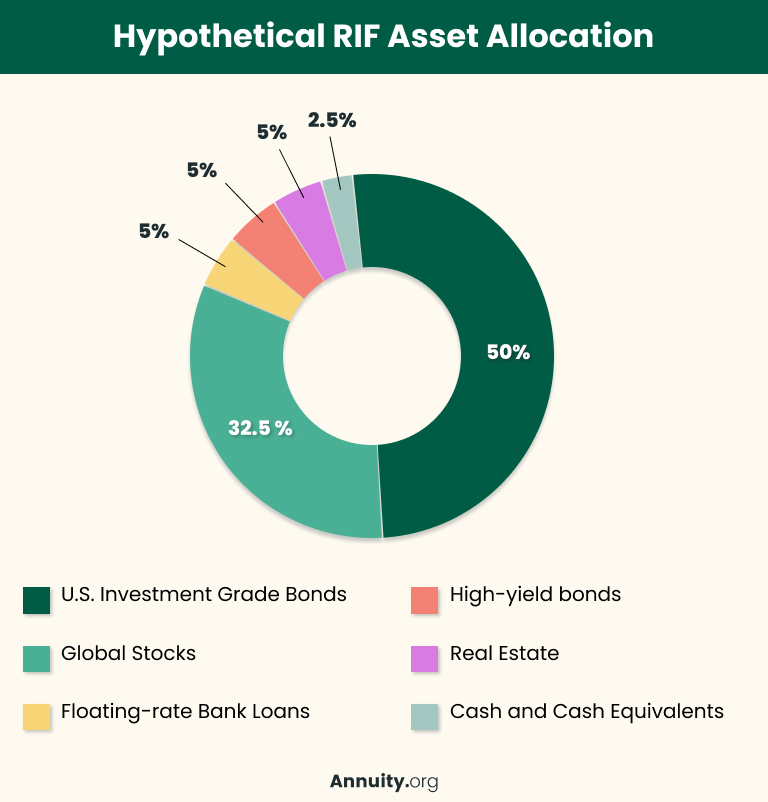

A hypothetical portfolio structure, which is commonly referred to as an asset allocation, is shown in the graphic below.

Fund Allocation Strategy Explained

- In this hypothetical strategy, the sample RIF portfolio is anchored by its diversified exposure (50.0%) to investment grade bonds, which includes U.S. Treasuries, corporate bonds, mortgage-backed securities and other publicly traded, asset-backed securities. These high-quality bonds are expected to generate the most significant amount of income for the portfolio.

- The second-largest exposure in the fund is to global stocks (32.5%), which generate dividend income and provide growth potential to protect you from longevity risk, which is the possibility that you will outlive your retirement savings.

- The third-largest exposure (15.0%) reflects the aggregation of three yield-enhancing assets — floating-rate bank loans, high-yield bonds and equity positions in real estate.

- The remaining allocation is to cash and cash equivalents (2.5%), which provide a source of liquidity.

Benefits of Retirement Income Funds

The key benefit of RIFs is the large amount of income they can produce in a low-risk manner.

Because they are considered low risk, RIFs can be invaluable to retirees who are looking for a reliable means to cover their day-to-day expenses and, possibly, fund nonessential purchases.

On the surface, RIFs are well-suited for retirees.. The funds offer the simplicity of an all-in-one portfolio with diversified exposure across several strategically coordinated types of asset classes. However, as outlined below, RIFs can have some notable drawbacks.

Mapping Out Your Retirement: Are You on Track?

Drawbacks to Retirement Income Funds

There are four noteworthy risks you should be aware of when considering a retirement income fund:

- Price volatility

- Credit risk

- Limited growth potential

- Excessive fees

Price Volatility

The most prominent risk associated with RIFs is their exposure to price volatility, which can arise for many reasons, including fluctuations in the stock market, rising interest rates and liquidity concerns. Because of this price volatility, a RIF should never be considered a guaranteed source of income. While most of its underlying assets may exhibit a high degree of stability, a RIF will always exhibit some degree of downside risk.

Credit Risk

The second most notable risk associated with RIFs relates to credit quality, which is a measure of a borrower’s ability to repay a debt. Some RIFs may invest in the debt instruments of financially weak companies or government bodies in an attempt to boost yield. This situation can lead to defaults and investment losses.

Limited Growth Potential

The third risk relates to asset allocation. While bonds and other interest-bearing debt instruments form the foundation of nearly all RIFs, stocks are another important component. Unfortunately, some RIFs hold an insufficient amount of stocks, limiting the potential for growth and increasing the risk you will outspend your investment.

Excessive Fees

The final risk to note is one that can extend to all corners of the RIF universe — excessive fees. In an ideal world, you’d pay the lowest possible fee and generate the highest possible stream of sustainable income. However, not all RIFs are created equal, and not all investment products are fairly priced.

Consider the Risks

Before you invest in a RIF, carefully assess its nature, the quality of its management team and the competitiveness of its fee structure. It’s also important to recognize that RIFs can be either actively or passively managed.

Passive management is less expensive than active management, but active management is often best for RIFs, especially when the funds involve complex assets with unique risk profiles. The complexity of some RIFs may warrant a higher management fee, but in general, you should avoid RIFs with excessive fees.

It’s not uncommon for more complicated RIFs to levy an annualized management fee of 1%.

Closing Thoughts

Investing your money in a retirement income fund can be sensible, if the RIF you select is structured properly and priced economically. Be sure the RIF holds a diverse mix of assets to provide a sustainable stream of income, adequate growth potential and the ability to withstand market volatility, credit deterioration, inflationary pressure and illiquidity.

Finding a RIF that fits these requirements isn’t easy, but it can be done. Nevertheless, you may be reluctant to rely solely on a RIF, given the possibility of outliving your savings. If you are highly risk averse, an immediate or deferred annuity may be a better alternative — or a reassuring complement — to a RIF. Learn more about these insurance products.