Key Takeaways

- Annuities can be classified by how they grow over time and how their payments are received.

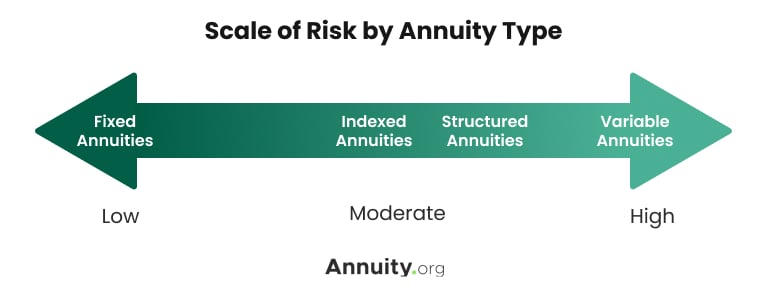

- The main types of annuities are fixed, variable and indexed.

- Each type of annuity has its own level of risk and payout options.

Main Types of Annuities

There are several different ways to categorize the different types of annuities. One of the most popular classifications is based on how the annuity grows in value.

Fixed, variable and fixed index are the main types of annuities based on growth. You will have to consider your level of risk aversion — how you weigh preserving your investment against the potential for higher returns — when choosing.

- Fixed Annuity

- A fixed annuity offers the least risk and the most predictability. Fixed annuities come with a guaranteed, set interest rate that doesn’t vary beyond the terms of the contract. While other investments might soar or dive, a fixed annuity is steady. Sometimes, however, the interest rate will reset after a predetermined number of years.

- Multi-Year Guaranteed Annuity (MYGA)

- A multi-year guaranteed annuity, or MYGA, is a type of fixed annuity. It offers a fixed interest rate for a specified period of time, typically for three to 10 years. A MYGA is generally best suited for people nearing retirement and looking for a way to defer taxes while guaranteeing a return on their investment.

- Variable Annuity

- A variable annuity provides you with periodic payments based on the performance of subaccounts that fund the annuity’s growth. So, your payments may fluctuate. Subaccounts work in a way similar to mutual funds. The amount of your payments may be higher if the subaccounts perform well, or they’ll be smaller if the subaccounts lose value.

- Fixed Index Annuity

- The payout you received from fixed index annuities is tied to a market index such as the S&P 500 or Nasdaq. Fixed index annuities also protect you against losing any of your principal if the index declines. This makes a fixed index annuity safer than investing directly in an index fund. To pay for this protection, fixed index annuities set limits on both your gains and your losses.

Types of Annuities Based on Growth Potential

Taking the time to know and understand the different types of annuities can help you make a more informed purchase decision.

How Annuity Growth Impacts Interest-Rate Risk

The type of growth your annuity contract uses comes with a degree of risk. Generally, the more predictable your annuity’s growth is, the lower the risk. However, lower risk also means your growth potential will likely be somewhat limited.

In terms of annuity types, fixed annuities carry the least risk and tend to have lower potential returns. The main interest-rate risk with a fixed annuity is missing out on a better rate down the line, as Nate Nead told Annuity.org. Nead is the managing principal at Invest.net and a FINRA Series 63 license holder.

“If interest rates start going up during this time, new fixed annuities with higher rates might be more appealing to folks than existing ones — leading to potentially lower returns for current fixed-annuity holders,” Nead said.

Variable annuities have a higher potential for growth but come with an increased risk. “Interest rates don’t have quite as direct an effect on variable annuity investments, but they still matter since they do impact changes throughout general market conditions and the overall investment environment,” said Nead.

Fixed index annuities carry a moderate level of risk and a somewhat predictable return. Because they are also based on equity market growth, interest rates can indirectly influence the performance of indexed annuities through changes in market conditions, including inflation.

| Type | Interest | Risk | Reward |

| Fixed | Preset/guaranteed | Low | Predictable |

| Variable | Tied to an investment portfolio | High | Potentially higher or lower |

| Fixed Index | Preset minimum rate that can change according to the stock market index | Medium | Won’t sink below a set level |

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

Types of Annuities by Payout Options

Defining annuities by payout can mean two different things. You can categorize annuities either by when you begin to receive payments or by how long you’ll receive payments from the annuity.

When defining annuities by when payments start, the two types are immediate and deferred.

- Immediate Annuity

- With an immediate annuity, also known as an income annuity, you begin receiving payments within a year after purchasing it. An immediate annuity is typically funded by a retirement account such as a 401(k) and is a good option for those ready to leave the workforce but still want to maintain a steady income.

- Deferred Annuity

- With a deferred annuity, you receive payments that start in the future. Typically, this happens when you retire. In the meantime, your investment grows on a tax-deferred basis. In addition to when you start receiving payments, you can choose how long you want to receive payments.

Typically, annuity payouts are used to protect against longevity risk. Annuities can provide guaranteed lifetime income, so you don’t outlive your retirement savings. But you can also arrange for an annuity to pay out over a fixed period of time.

Types of Annuities Based on When Payments Begin

Annuities can also be classified by how long payments are guaranteed. The four main types of annuities based on payout length are fixed-period, straight life, life with period certain and joint and survivor annuities.

Fixed-period annuities are the most straightforward. This type of annuity spreads out payments over a fixed period, typically for 20 or 30 years. With these annuities, the age and health of the annuity holder do not affect the amount of the payments.

A straight life annuity, also known as a lifetime annuity, guarantees annuity payments for a person’s lifetime. The person whose life expectancy the annuity is based on is known as the annuitant. The annuitant’s age and health are used to calculate the amount paid out each month.

Lifetime annuities are one of the most popular annuity types because they guarantee you will not outlive the income the annuity provides. Even if the total of the payments you’ve received exceeds the value of the annuity, you’ll continue to receive payments as long as you live.

Life with period certain annuities also promise payments for the annuitant’s lifetime but have some extra features. The period certain feature means that payments are guaranteed for a period of time, usually for 10 to 20 years, even if the annuitant passes away before the period elapses.

If that happens, the remaining years of payments will be made to the beneficiary named in the annuity contract. But if the annuitant lives beyond the period certain term, they will continue to receive payments throughout their lifetime.

The final type of annuity payout is a joint and survivor annuity. These annuities are most often used by married couples who want to set up an income stream that will last both their lifetimes.

A joint and survivor annuity continues payments for the remainder of two people’s lives. After the primary annuitant passes away, payments continue to be made to the surviving secondary annuitant. The IRS dictates payments made to the survivor must be no less than 50% and no more than 100% of the amount paid to the first annuitant.

Types of Annuities by Premium

Options for purchasing a deferred annuity include with a single lump-sum premium or a series of payments over time.

Single premium annuities, as the name suggests, are purchased with a single lump-sum premium. One of the more common products that use this option is a single premium immediate annuity (SPIA).

A SPIA allows you to make a single lump-sum payment and begin collecting a steady income stream in less than 12 months. It’s also called an immediate annuity or income annuity. They account for about 10% of annuities sold each year and are preferred by people close to retirement age.

Two types of annuities accept multiple premium payments. The first is known as a flexible premium annuity. All flexible premium annuities are deferred annuities, allowing you to make payments over a long period of time with the promise of a payout in the future. Some may allow you the flexibility to contribute without a schedule or a minimum number of routine payments.

The other kind of annuity with multiple premium payments is called a periodic premium annuity. With a periodic premium annuity, you make payments at regular intervals, such as monthly or quarterly.

“You’ll continue making these payments until either reaching a certain accumulation value or for a specified period, such as five years,” said Nead. “Periodic premium payment is often associated with deferred annuities that include systematic withdrawal plans.”

Read More: First-Time Annuity Buyers

Other Annuity Choices

A wide variety of annuities exist beyond the most common types. These can be tailored to your specific needs and long-term financial goals.

There are options that allow you to take advantage of tax breaks for qualified retirement accounts, such as traditional IRAs and 401(k) plans. You can also set up annuities to continue payments to beneficiaries after you die.

- Long-Term Care Annuities

- A tax-deferred annuity with a rider that sets up payments for long-term care if you need it in the future.

- Group Annuity Contracts

- Annuities offered through employers as part of a retirement benefits package.

- Charitable Gift Annuities

- Annuities purchased by charities on behalf of donors using the donor’s financial gift to the charity. The donor receives payments until their death, upon which the charity receives the remaining balance.

- Individual Retirement Annuities

- Annuities that provide tax benefits similar to an individual retirement account (IRA).

- Registered Index-Linked Annuities

- A RILA uses a stock market index to determine gains and losses and lets you set the maximum loss you are willing to tolerate.

- Thrift Savings Plan (TSP) Annuities

- An annuity purchased using funds from a TSP account

- Pensions

- Annuities are not pensions, but pensions can be an alternative to an annuity for those who can access them.

- Perpetuities

- Like annuities, perpetuities are insurance products that offer guaranteed income in exchange for upfront payment. A perpetuity, unlike an annuity, has no payout expiration date.

Other options include:

Lock In Fixed Annuity Rates as High as 6.9%

Finding the Right Type of Annuity for You

There are pros and cons to each type of annuity. You should consider how the features of different types of annuities work best for your current financial situation and how each can help you reach your long-term financial goals.

You should also compare several different annuity options, ask yourself how each meets your needs and talk to a financial professional about how each annuity you’re considering will help you achieve your goals.

- Understand how you’ll use the annuity.

- Ask yourself how you plan to use the annuity — maybe for a guaranteed retirement income, building toward a retirement portfolio or as an inheritance for your spouse or children. Discuss these goals with a financial professional. This can make a big difference in the type of annuity best suited for you.

- Consider whether you’ll need the money right away.

- If you need the money in the next five years, you’ll likely have to pay costly surrender fees. These fees vary from insurer to insurer, so it’s important to understand how much of a penalty you may have to pay for an early withdrawal.

- Ask about waivers if you may need the money right away.

- Consider a waiver that lets you take out money right away in the event of an emergency, such as a serious medical event or the need for long-term care. Some annuities can include a waiver dropping early withdrawal or surrender fees for these emergencies.

- Know all the fees you’ll have to pay.

- Insurers may charge annual fees in addition to upfront fees when you first purchase your annuity. You can typically find information about fees in the prospectus. Look at the overall cost of fees in the long term and consider how much they eat into your benefits over the lifetime of the annuity.

- Get quotes from at least three insurers.

- Payout options vary from insurer to insurer. Compare annuities to get the best value. Consider buying multiple annuities from different companies based on what your state regulations allow.

- Make sure the company is solid.

- Make sure you’re buying an annuity from a company that’s financially sound. If a company goes under, it could take years to get your money back. Check the company’s ratings with multiple financial ratings agencies such as S&P Global, Moody’s, AM Best and Fitch. This will give you an idea of how strong a company is.

- Know the minimum guaranteed return.

- The minimum guaranteed return is the very minimum amount of money you’ll receive each year from your annuity. This can be straightforward with a fixed annuity, but some variable annuities also guarantee a rock-bottom amount no matter what.

- Understand the death benefit options.

- A death benefit is money provided to your spouse or other heirs if you die. These options can vary. Ask about the options you have for how you want a death benefit to work with your annuity before you purchase it.

Checklist for Choosing the Best Annuity for You

Earn up to $6K Annual Interest on a $100K Annuity

Common Questions About Types of Annuities

There are several ways to categorize annuities by type. Annuity.org categorizes the types of annuities by payout, growth and premium options. These tend to be the most common aspects of annuities that people consider important when buying an annuity.

The main types of annuities are fixed, variable and fixed index annuities. Fixed annuities guarantee a fixed interest rate on your contributions over a period of time. Variable annuities provide a return based on the performance of their subaccounts. Fixed index annuities base their payments on the performance of market indices such as the S&P 500 or Dow Jones Industrial Average.

The best type of annuity varies from person to person. The type of annuity that is best suited for you depends on your current financial situation and long-term financial goals for an annuity. It is important to compare annuities to find the one that best fits your needs and goals. You should consider how you wish to pay for an annuity, the kind of growth you want an annuity to accomplish and the type of payout that suits your financial goals.

Guarantee financial freedom with an annuity.

Guarantee financial freedom with an annuity.